The wall between you and financial freedom is:

Knowing when to BUY a stock and when to SELL it.

As a stock trader and coach, I often get asked: “What is the best stock to buy?”

While that is a valid question, the answer really depends…

It depends on your goals, your risk level, and many other factors.

No matter what the stock, buying it will only get you into the trade or investment, but the key to actually lock in a profit is knowing when to sell. Let’s dive into the importance of knowing when to buy a stock and knowing when to sell.

The real question to ask…

To be a successful trader, the real question to ask is: “What are the best times to buy and sell stocks for maximum profit, if everything goes as planned, and for minimum loss, if things don’t go as planned?”

I have a process to find stocks I want to trade, as well as a process for entering and exiting the trade.

Step 1.) Find a Tradable PATTERN, Not Stock

THE FIRST THING YOU NEED TO DO

…is find a tradable pattern.

A tradable pattern is when you can clearly identify support and resistance lines on the chart and when the pattern is clearly repeating itself over a certain time frame.

Once you find a tradable pattern, then you have a candidate for a trade.

This is the key here: you need to be able to read stock charts and patterns, not necessarily have a long list of stocks.

You go out and find tradable patterns, not stocks.

All too often people are worried about the best stocks to buy but in the game of trading. You should be more worried about what the best patterns are with the highest percentage of predictability to buy.

Remember, we are trading patterns, not stocks, which may be a mind shift for some of you.

If you are not familiar with the most common reliable trading patterns or how to read stock charts, then you definitely need to dive into some education. I have a “Foundations” of stock market trading here which covers the best tradable patterns.

Step 2.) Determine Your Profit and Loss Exit Area

Tell me if this story sounds familiar: You have identified the perfect stock and you just KNOW it’s going to go sky high.

So you buy it.

The trade does go up higher, but you don’t sell because now you think it can continue to go higher, even into outer space.

Or…

Have you ever found a stock that you think can go higher, but as soon as you buy the stock it falls through the floor? Then you are left holding onto it praying it goes back up just to break even.

Sound familiar?

Well I was that exact same person in your shoes before, so don’t beat yourself up too bad.

In this step, it is imperative to know when you are going to close down the trade and lock in profit if the stock does what you think it’s going to do.

And even more important than that, you need to have a predetermined exit strategy in the event the stock turns against you and falls through the floor.

So how do you determine the best time to sell?

Here is the key… the answer is actually in the first step.

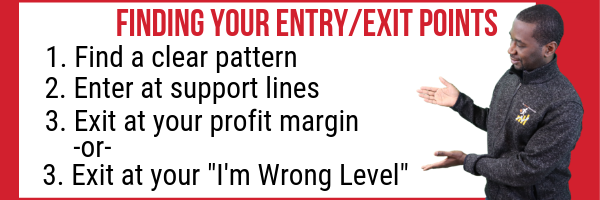

When you are looking at charts to find a tradable pattern – you should also be looking for an exit strategy.

A tradable pattern has an exit point already baked in!

If you are buying at support, then you should be selling near resistance, which is where you have identified to be your profit zone.

Once you find a tradable pattern which should include a well defined support level (which is where you would buy at) and a well defined resistance level (which is where you should sell at) then you should take action at those two levels.

Once you know how to read stock charts, you know to buy at support and sell at resistance.

Here’s a secret…

The stock may never get to your profit zone and in fact may fall below (support) which is ideally where you purchased the stock at.

For this reason you need to have what I like to call…. an “I’m Wrong Level“.

The “I’m Wrong Level” is a price on the chart that if the stock reaches that level, proves you were wrong about the stock going higher.

Your initial thesis was wrong.

You need to abort the mission; this is not the time for prayer and hoping it goes back up.

This is about saying my thesis was wrong (which is hard for most people because of our ego) and cutting your loses and moving on to your next trade.

This helps you MINIMIZE loss instead of watching the stock fall wayyyyyy past support and empty your trading account.

This one crucial secret which knocks most people out of the game because they never go into a trade thinking, “If I’m wrong about this, at what level do I get out?” Instead, they stay in and watch their entire account dissipate right in front of their eyes.

Putting it all together

Instead of trying to find the best stocks to trade or invest in, you need to find the best patterns with the most predictability to trade and invest in.

Once you identify the traceable pattern, you should be strategizing your entry and exit into the stock based on support and resistance that you have identified from reading a stock chart.

Before entering the trade, be sure to know when you are getting out if the stock hits your profit target.

More importantly, know when you are getting out of the trade if the stock hits your “I’m wrong level.”

These are the exact steps we use in our live Group Coaching sessions every week inside of Power Trades University. We discover real trades, answer the members questions, and take it over to the community throughout the whole week to give feedback on how everyone is doing in their trades. If you need assistance knowing where to buy and sell, that is where you need to be.

Follow this game plan and you’ll find yourself on the other side of money… the winning side.