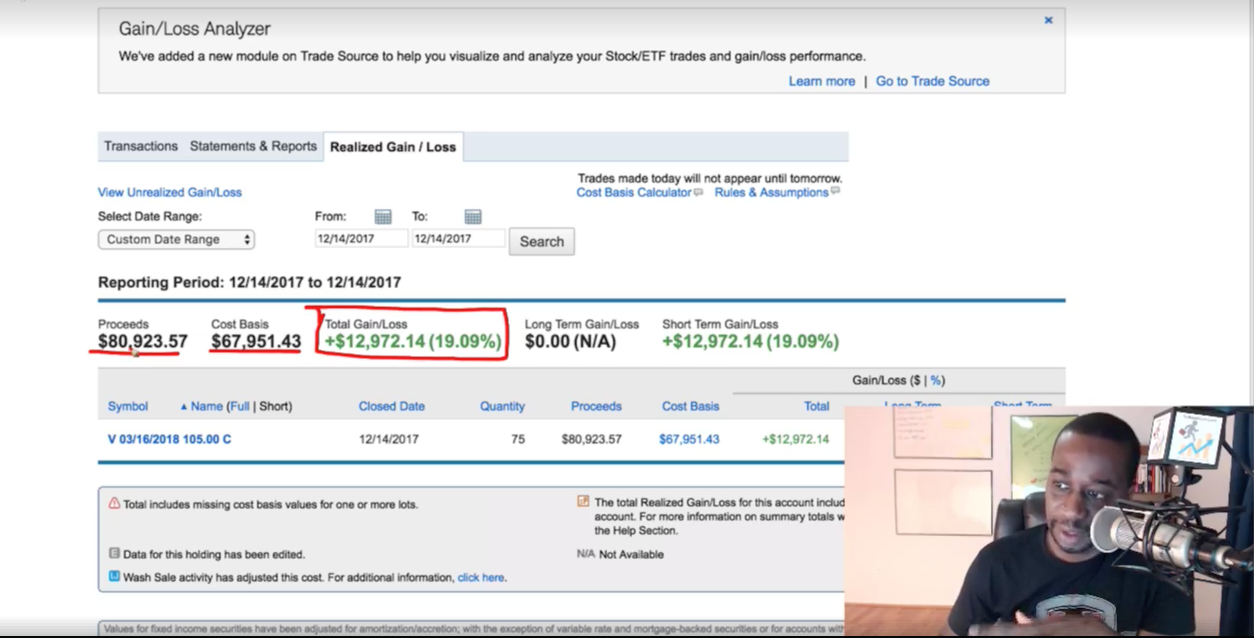

We were able to generate $12,000 in just 7 days in our Visa option trade. This is a real trade, with my real account, with real money. Discover the trade we made and why we picked this specific one.

We recently did a case study on how I generated $80,000 in profit from 3 option trades in under two months, click here to check out that case study in case you missed that one, and in this one I am going to break down a smaller trade where I made $12,000 within 7 days.

When some people hear about a 19% return, they may think that is only possible as an overall figure annually. But I want to make sure and show you the power of option trading, and how it is possible to make these types of percentages with each option trade.

The real purpose of this is to show you what’s possible with education on how the strategies work, and how to make it work for you personally.

$12,000 in 7 Days: The Analysis

So let’s break this particular trade down.

The Trade: Option trade with V (Visa)

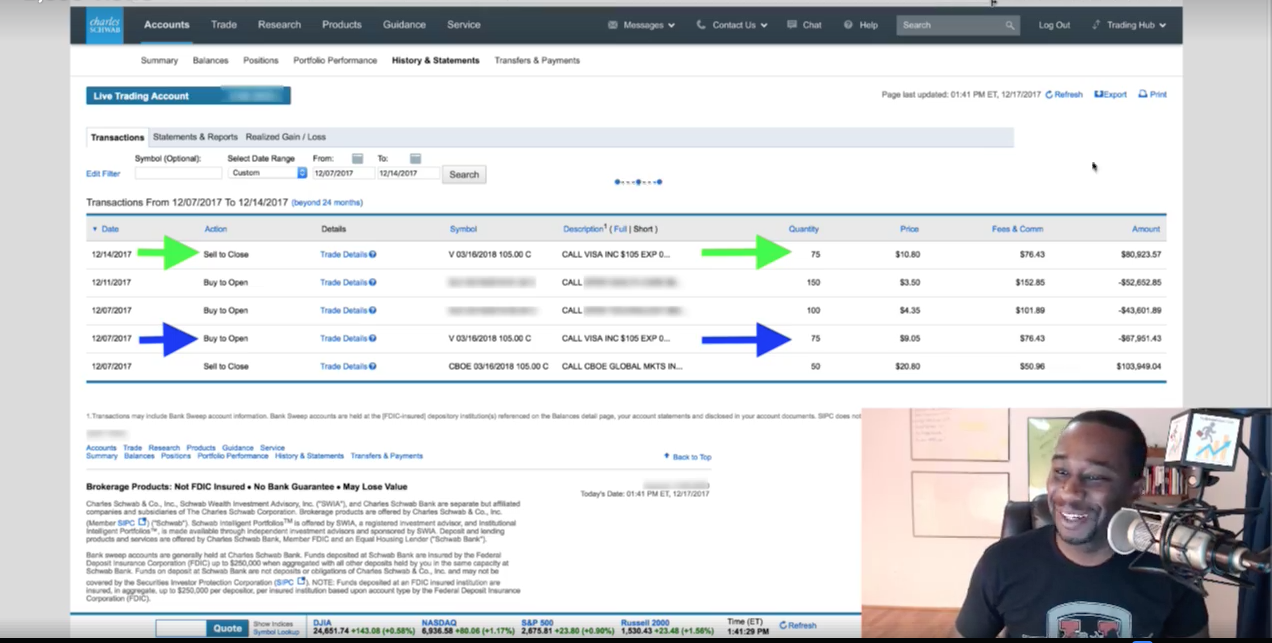

Opened the trade: 12/07/17

Closed the trade: 12/14/2017

Cost: $67,951

Proceeds: $80,923

TOTAL PROFIT: $12,972

Return: 19%

The Percentage

Sometimes people worry about the big numbers and how much I am able to trade or others are able to trade. But no matter what you are personally trading, you are still making a 19% return. So let’s say that you entered this trade with $1,000. A 19% return is 190 dollars for you, but in just 7 days! That could be your car payment made in just 7 days.

What if you had $2,000? That would have been about $380 profit. I started with just $500 when I started trading. I did not have this kind of capital either, but I knew I could grow it. The point is: 19% is 19% no matter how you slice it or what you are trading with.

The Timeframe

We looked at Visa and bought 75 contracts of the 105 call option on 12/7/17. We got out of the trade just 7 days later.

The Reasoning

I want to break down what was going on with Visa and why it motivated some of us in the Group Coaching program within Power Trades University to get in.

Visa’s chart is moving in an uptrend. And I know people have asked me in the past, how do you catch these trades? We look for them every week live in our webinars within Group Coaching. And in one of the sessions we noticed that Visa was in an up-trending pattern. We know the best time to sell is when it hits the top of the channel. The best time to buy is when the stock hits the bottom of this particular pattern. So in the webinar we saw that the stock was achieving this pattern and we bought at the optimum time, at the bottom on the channeled pattern.

We were bullish in this trade until the pattern reached back until the top of the channel and it was the best time to sell. This can be used both long term and short term. We trade the trend until it tells us to get out. And this pattern just happened to be 7 days.

Stock VS. Options

That allowed us to find the best option – which was the 105 call option. We were able to control Visa without actually buying it at the 105 price point. And as the stock rose to 113, the price of the option rose because it became more valuable.

We got 75 contracts at $9.05 price. I was controlling 7,500 shares of Visa. If you were to buy that, it would c ost $787,500. That is how much it would cost to do it with stock. I only needed about $67,000 to do the same trade. And THAT is the power of trading options.

ost $787,500. That is how much it would cost to do it with stock. I only needed about $67,000 to do the same trade. And THAT is the power of trading options.

You can click here to check out my free webinar that holds more education about trading options.