Is the U.S. Stock Market Oversold?

https://youtu.be/FwbNej7QpbM

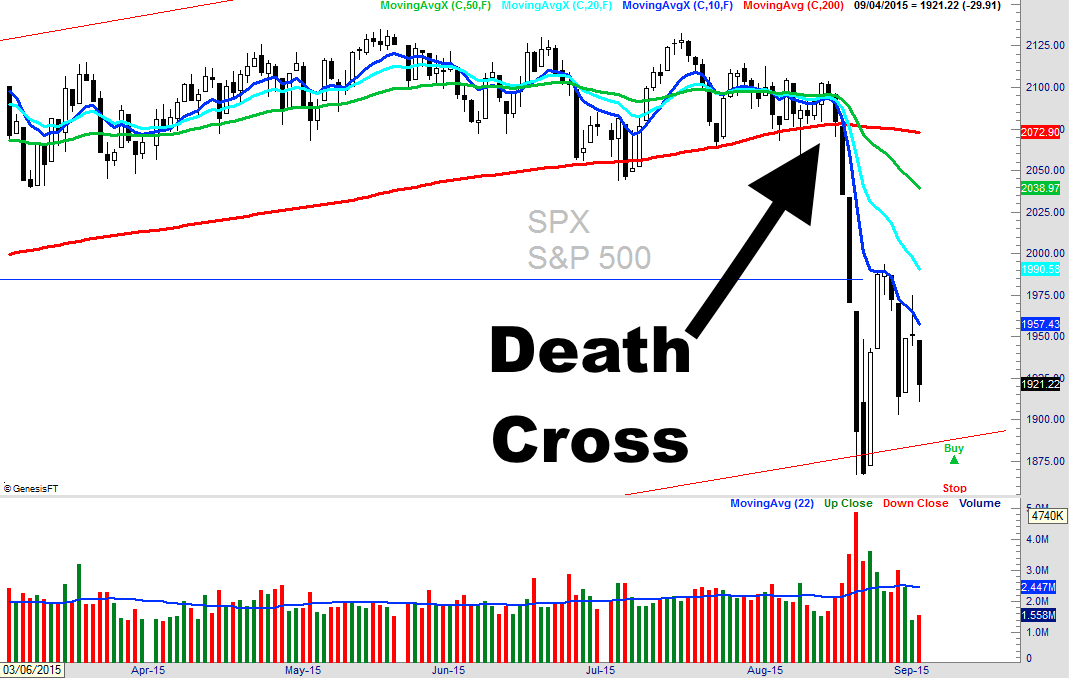

With all the discussion around the U.S. Stock Market and the infamous “Death Cross” of the major indices like the SPX. But what exactly is the death cross? The definition is when a short term moving average, specifically the 50 day moving average (royal blue line in image below) crosses a longer term moving average like the 200 day moving average (red line see image below) to the downside. This technical action signals a bearish trend in a stock or the overall market when referencing the S&P500 hence the recent sell off.

As a trader the death cross is not as important as is knowing and understanding where the overall market will find support from the sell off thus giving you a respectable entry to begin to put money to work.

I think it’s more important to ask yourself

1.) when is the market truly oversold?

2.) When would I be ready to buy some of the stocks that have ran up too high but have now pulled back?

3.) How long am I willing to hold these stocks/trades.

If you do not know how to read stock charts and understand where support and resistance is, which is ultimately where you should buy and sell then it doesn’t matter what fancy names they come up with for charts you are basically at the mercy of the news casters and fancy talking tv shows. I encourage you to learn to read the charts for yourself. Check out the “Foundations” course to start building a solid foundation so you can make your own informed decisions on where the market is at and where it’s going.