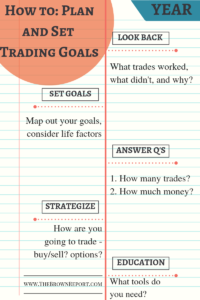

It’s a new year and that means new goals and kicking it off right in the stock market. Let’s talk about how to map out your stock trading year, which includes looking back on previous trades, setting goals, answering some questions, strategizing, and getting education.

I believe in order to get where you are going this year, there are a few key things you need to do with respect to planning.

You can also listen to the podcast on iTunes and Stitcher

“To know where you are going, you need to know where you have been”

Number 1 I believe you should reflect on the past – where you have been, the experiences you had, what worked, and what didn’t work. Reflect on your past stock trading experiences to help you frame your current stock trading plan.

And Number 2 I believe you should have a road map for where you’re going. Can you imagine getting in a car and saying I’m going to drive to California from Michigan with no map or, these days, no GPS?

You’re basically saying, I’m just going to get in the car and drive and see where I end up…” I’m not sure how successful of a trip this will be.

If you don’t know where you’re going, you may stop short and give up just before you get to California thinking there’s no point and turn back around.

For many of us turning back around means going back to the comfort of a job or just settling for the car you have, the house you have, not the dreams you have for them.

It means “Awwww forget putting the kids through college – they can just take out student loans”.

So in this episode I want to walk you through how to plan your stock trading goals so you can be laser focused on what you have to do this year and for years to come.

Now before we get into the episode, I do want to let you know about my Group Coaching program: Power Trades University, we just closed the doors from accepting new members and we will open up again some time in April.

This is where the members and I meet online live for 2 hours every week, and I go through my scans, over the S&P 500, the NASDQ, the DOW and we look for real trades in real time and then look for the corresponding option to trade. I post all the trades on what we call the “Trade Tracker”, so for those who are always asking what trades I am looking at, when to get in and when to get out – this is the platform where I share.

You also have the ability to come on the webinar live and ask questions or ask about a stock you are watching and there’s a private community forum to network with other traders. You can post screenshots and videos of your trades on this forum, tag other members or tag myself, you can view each other’s profile and network, search stocks and other key words, and whole bunch more in the forum.

I wanted to let you know about it because we sold out the seats for this and if you want to jump on the waiting list to be one of the first to know when we open back up, you can visit www.PowerTradesUniversity.com

Looking Back

Let’s talk about where have you been. It’s always a good idea to reflect, and since this is a new year, you want to look at your 2016 – but it’s also a good idea to do this monthly or quarterly as well.

Some of the questions you want to ask yourself are:

1.) What trades worked for me last year?

2.) What trades went against me last year?

3.) Of the trades that went well for me, what pattern or strategies worked best for me?

4.) Of the trades that went against me, did I follow my rules? Did I break my rules? If so, why?

You want to leave with a sense of: “If I continue to do the things that worked for me and trade what I know, I should get the best results”

and

“If I can eliminate what didn’t work for me and stick to my rules, I shouldn’t suffer any catastrophic losses”

Write down your answers in a notebook or on a piece of paper – it is amazing what you can see when you physically have to write out your answers. It will help you connect with this exercise, whether you do it now at the beginning of 2017, throughout the year, or into the future. Then you can look back, and see if you are still having the same problems or if you are sticking to the strategies that are working for you.

Goal Setting

One of the things I find most helpful is to keep the end in mind. I often hear people say, “I want to make six figures in the market this year”.

Which is a fine goal, but do you know what it takes to make six figures in the market? Well hopefully after this exercise you will have a clearer picture.

So let’s map out the game plan…

Keeping the end in mind, the goal is to make six figures.

The next step is to now divide it up by 12, which would mean you would need to make roughly $8,333 and some change a month from the stock market.

Now we can’t just stop there and say, “Good I have my monthly goal”, there’s a few more factors we have to take into consideration.

Factor #1 is trading time: There will be periods of times where you don’t trade due to earnings seasons, some economical event, or just the fact that there are no good trades. I like to allocate at least a month to this time frame.

Factor #2 is life factors: Holidays, vacation, time with the kids or loved ones, heavy workload at work, or being physically ill. We have to make time for “life”, and I like to allocate at least a month to this time frame as well.

Hopefully you can see where I’m going with this – we went from needing to make $100,000 in 12 months to needing to make it in 10 months. If you do not consider this time, what you are saying is that there will always be something to trade and life will fair perfectly for this year. That just simply is not true. Bake in the time up front, then when things do occur, you are already prepared and you will not feel guilty for taking some time where you are unable to trade, all the while still hitting that goal.

With that being said, our new goal is now $10,000 a month.

How Many Trades Per Month?

The picture should be getting clearer: we have our target goal of $100,000, we now know we have roughly 10 trading months to hit that target, and we know how much per month we need to generate.

Let’s get a little more granular.

Now it’s time to ask yourself, “How many trades per month is it going to take?” Is it going to be four trades a month shooting for $2,500 per trade? Is it going to be two trades a month shooting for $5,000 a trade, or is it going to be 1 trade a month shooting for $10,000 a trade?

Your answer to this question leads us to one of the second most important questions and that is…

How Much Money is it Going to Take?

It sounds good to say, “I’m going to make one trade a month at $10,000 profit” – but the reality is, do you even have the buying power to make that kind of a bold statement?

What most people do is come to the game with $2,000 and say I’m going to make $10,000 a month. It’s just not realistic. This is where reflecting on the past comes into play because if you can look back at some of your old trades and say, “Hmmm had I had $15,000 of trading capital, I would have made $5,000 on those trades” and you can start to see what type of capital you may need in order to pick your monthly break down.

Don’t get discouraged if you do not have that kind of capital yet – it is a percentage game. If you were taking 500 bucks and making 100 bucks a month, then you can times that by 10. Which means if you had 5,000, you would have been making 1,000 a month. Then times that by 10 again – 50,000 means 10,000 a month. Reflect back on what you were able to generate with the money you have, and know how much potential you have with the exact trades with more buying power.

What sacrifices can I make now to grow my account? What am I going to do to get my bank account to the necessary amount to reach my ultimate goal?

Once you figure out how much money it’s going to take the third and probably most important question you can ask yourself is…

What is Your Strategy?

What strategy is going to get me there? If we were to break down a few strategies there’s things you would have to consider for each one.

Strategy no. 1 – Are you going to buy and sell stocks? If so, then you have to decide do I have enough money for strategy 1a.) which would be buying and selling high price high moving stocks, or do I have only enough money for strategy 1b.) buying and selling penny stocks?

You may decide to roll with strategy no.2 and that is options trading. Well are you going to focus on strategy 2a.) buying and selling call options or strategy 2b.) buying and selling put options or some combination of both?

Last but not least perhaps strategy no.3 – you do some combination of both 1 and 2. Perhaps you buy stocks and you sell options against your stock.

Getting from Michigan to California, are you going to take the freeway or side streets? Your strategy is mapping out how you get to your goal.

Education

Ok so now let’s recap and wrap it up all up with “the Big E”…

Recap:

1.) Look back on your previous results and analyze what worked and what didn’t

2.) Set your financial goal for the next year, or five years for that matter

3.) Break it down to monthly goals

4.) Determine how much money it’s going to take, or how much you have to start with

5.) Pick out your strategy, or strategies

The 6th and final step is to ask the questions: “What type of education am I going to need? Do I already possess the skills and knowledge to execute my plans, or are there some missing pieces to this puzzle that I need to get fixed before this is my reality?”

Once you answer these questions, then the goal is to get the education you need to execute the plans discussed and then rinse and repeat my friend.

If you are new to the stock market, you may need basic education like the Foundations course to help get you started off right. If you already know the basics and need to learn how to control bigger stocks, you may be looking more into options trading.

As we wrap up, if I can be of any assistance to helping you hit your goal let me know by leaving a comment on the blog post.

Also, if you haven’t done so, I’d recommend checking out my Power Trades University Program which is my group coaching program where I analyze all the major indexes the S&P 500, I look for trades in real time and I look for the option strategy to execute for maximum profit. Plus, I have over 150 hours of coaching sessions in there to help you hone your trading skills to review.

Also, if you haven’t done so, I’d recommend checking out my Power Trades University Program which is my group coaching program where I analyze all the major indexes the S&P 500, I look for trades in real time and I look for the option strategy to execute for maximum profit. Plus, I have over 150 hours of coaching sessions in there to help you hone your trading skills to review.

But please, take this exercise seriously. Look back, look at your goals, ask yourself the necessary questions, figure out your strategy, and find your education that you need.

Let’s set your goals, map them out, and get you to your destination.