A Step-by-Step Guide to Using Thinkorswim’s Powerful Web Interface

If you're diving into the Thinkorswim web platform for the first time, or you're coming back after Charles Schwab's acquisition, you're in the right place. Today, I'll walk you through the basics of paper trading, setting up stock charts, buying and selling options, and a whole lot more. Let’s dive in.

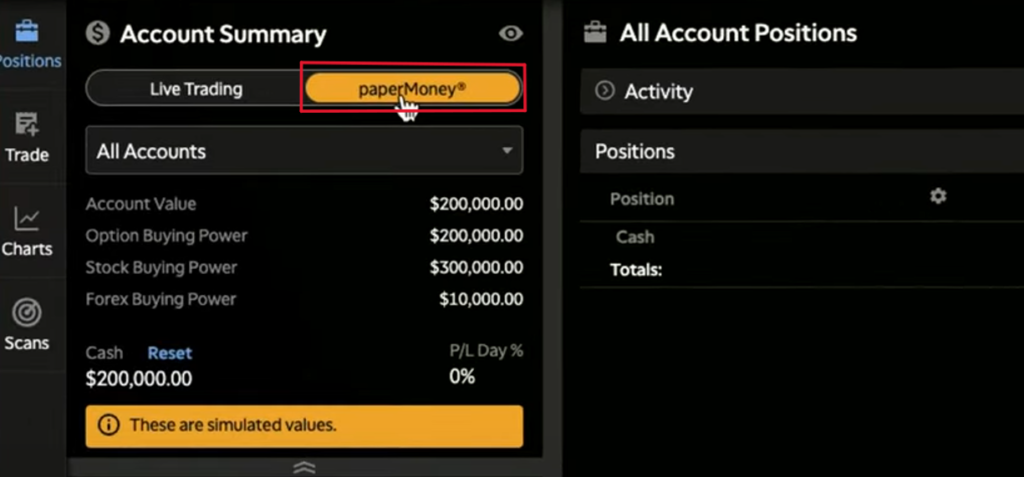

Switching from Live to Paper Money [00:00:57]

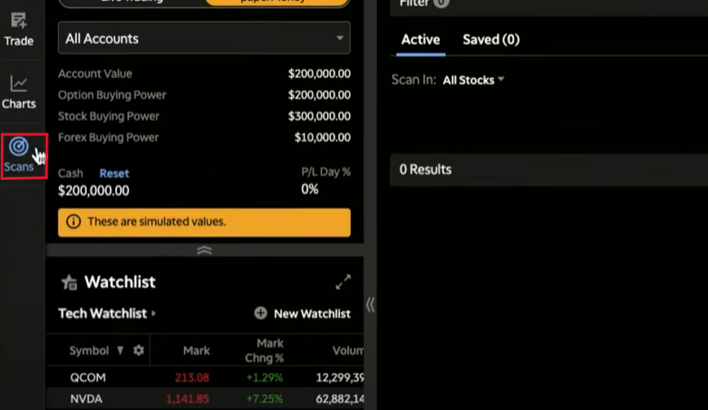

One of the first things you'll notice when you open the Thinkorswim web platform is the option to switch from live to paper money. This is essential for practice trading without risking real funds. Just click the "Paper Money" to transition to the simulated values. There, you can reset your balances or add fictitious funds as needed.

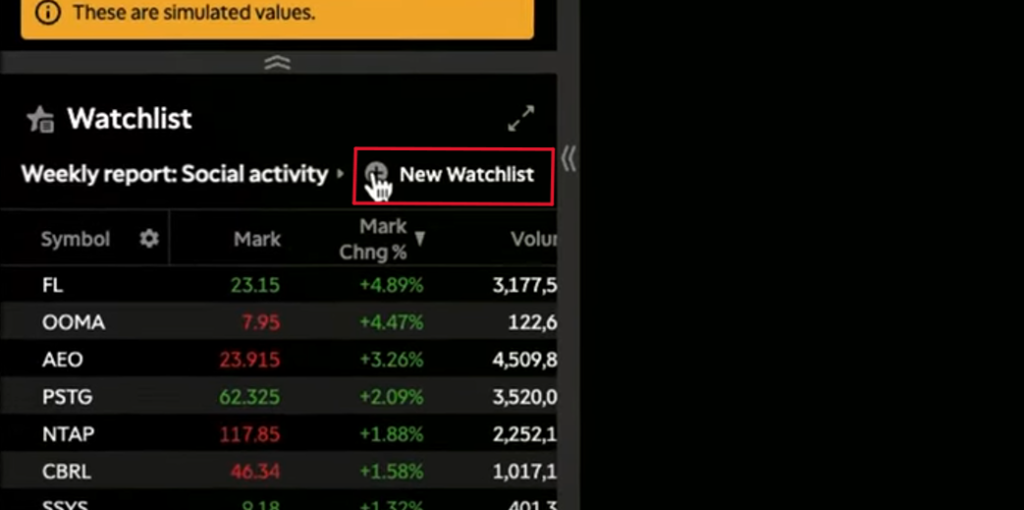

Creating Your Watch List on Thinkorswim [00:01:36]

Your watch list is a powerful tool for keeping an eye on stocks that interest you. To create a new watch list, simply hit the plus button. Then, name your watch list – for instance, "Tech Watch List" – and start adding symbols. Next, type in the symbols for companies like NVIDIA, AMD, and IBM, and just like that, you’ve got your curated list.

Want more control? You can view gainers, losers, analyst upgrades, and even filter by industry or market cap. The platform allows for dynamic watch lists that update based on your criteria – be it top gainers on the Nasdaq or movers in the S&P 500.

Managing Positions and Placing Trades [00:04:18]

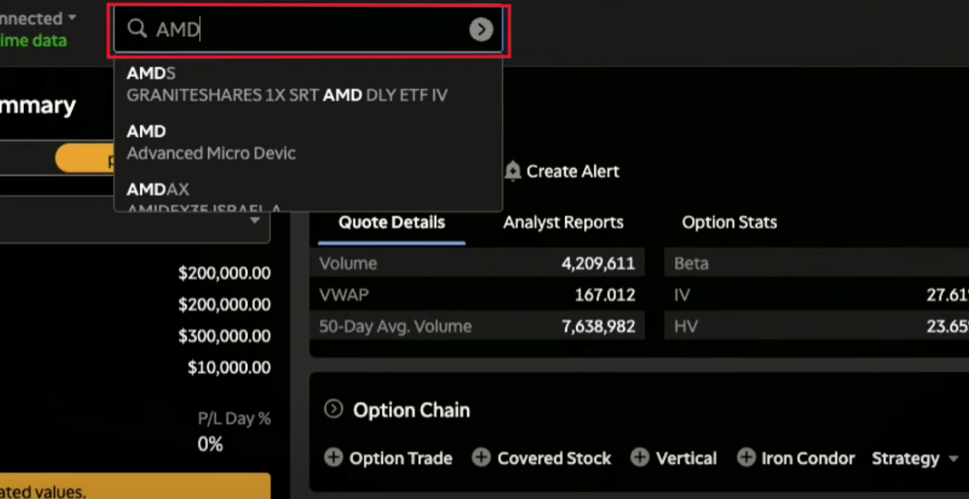

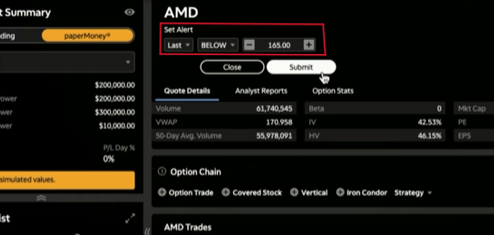

The heart of trading on Thinkorswim is in managing your positions and placing trades. If you have open positions, they’ll appear in the middle of your screen. To place a trade, just click "trade" and search for the symbol, like AMD, switch symbols if necessary, and you’re ready to go.

Set up an alert for price movements or add stocks to a watch list. You can also dive straight into options trading with various pre-constructed strategies available, including covered calls and vertical spreads.

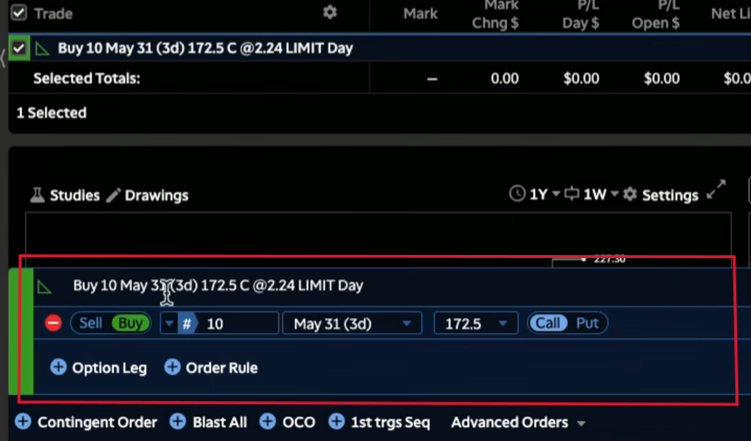

When you’re ready to execute more intricate plays, your option chains are your go-to. First, select the desired expiration date and strike price. Whether it’s a 160 call or exploring straddles, Thinkorswim has you covered.

The intuitive interface even lets you set market orders, limit orders, and stop orders. Just adjust parameters like number of contracts, expiration dates, and more to suit your strategy.

Thinkorswim In-Depth Charting and Technical Analysis [00:12:40]

Visualizing stock performance is a breeze. Whether you prefer a one-year weekly or a six-month daily chart, you can customize the chart. Even with numerous indicators like Bollinger Bands or MACD. Want real-time streaming data? Thinkorswim provides intraday charts that keep you updated with every tick.

With Thinkorswim, you can draw trend lines and add price levels. Also, annotate your charts to visualize breakouts, trends, and patterns that align with your trading strategy. Overlay multiple studies like moving averages or stochastic indicators to refine your decisions.

Utilizing Scans and Filters [00:19:52]

Thinkorswim Takeaways and More Tutorials

The Thinkorswim web platform offers a user-friendly, powerful interface for traders of all levels. From creating custom watch lists to executing complex option strategies and performing detailed technical analysis. The tools at your disposal are vast. Although it lacks some of the depth of the desktop version, it’s a fantastic starting point for paper trading and getting comfortable with the Thinkorswim ecosystem.

I hope this comprehensive guide helps you get started. Don’t forget to subscribe to my YouTube channel (https://www.youtube.com/@brownreport) and hit the notification bell to stay updated on our latest tutorials. See you in the next session.