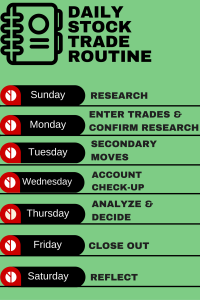

Stock Trading Routine

In this post, I am going to share with you my daily stock trading routine. Now you can use it to maximize your time with the stock market. Hopefully this framework will allow you to not be as overwhelmed and help you to map out your time.

Sunday – Research

Look at the S&P 500 and see where we finished for the week and what I believe we are in store for the upcoming week.

- Are we in a bullish market?

- Are we in a bearish market?

- Are we trending sideways?

Look at what trades need to do what this week for me to be ready to enter or exit the trade.

Keep a written or digital log of my thoughts of these trades.

Monday – Enter Trades & Confirm Research

Watch the market open and keep tabs on any trading ideas I found on Sunday night to see if they are playing out at the start of the week.

- Did the stock start out strong and stay strong throughout the day?

- Did the stock start out weak and then gain momentum toward the end of the day?

- Did the stock start out strong and then sell off near the end of the day?

After the market closes, I go through new stock scans and screens to see if anything new comes up on my Radar that did not over the weekend. So I’m looking for new Gainers and Losers on Monday.

Tuesday – Secondary Moves

I make my moves on any stocks that I found Monday that are highly probable for moving toward the strategies I mapped out on new stocks Monday or stocks I already looked at from Sunday night.

- Are there any new movers and shakers?

- Did some of my stocks from Sunday’s night research move into the buy or sell zone?

Time Frame to enter a trade is usually between 3-4pm.

Wednesday – Account Check Up

Wednesday – Account Check Up

- Are my stocks performing like I thought they would after three days into the trading week?

- Do I need to send in any money to be ready for some moves and countermoves?

Light day: check my alerts, see if my stocks or options are performing and if any adjustments need to be made.

Thursday – Analyze and Decide

- Is it time to cut my losses on any trades?

- Do I need to lock in profit on any trades?

- What strategy adjustments are we executing on Friday?

What decisions do I need to make for Friday? Are there any stocks that are losing? Any that are winning and I may need to consider increasing my stake. Thursday is a day of determining what you have to do Friday especially if you have options expiring.

Friday – Close Out

- Close out Losers

- Lock in profit on Winners

Execute all closing trades before 12 noon.

Saturday – A Day of Reflection

Morning -usually 8am – 10am – reflect on the previous trading week. What went well, what went not so well. Is there anything I could have done differently, should I have seen a pattern differently, did I set my stop correctly, did I break my own rules, and why?

Spend this time to reflect on your trading and make adjustments. Keep a journal so you can see any patterns in your trading are showing up be it good or bad.

Listen to the podcast on these platforms: