"The stock is pulling back! Should I get out??"

The answer may surprise you.

In the stock market, there are stocks that have great up-trending charts, but also have occasional pull backs. If you are investing and a pull-back or dip occurs, what should you do?

Well in this unique episode, the Brown Report Team and I break down what it means to have a "healthy" pull back and how that can help keep some fear at bay.

Join Antonio, Makayla and myself by checking out the episode below.

Audio Version:

You can also listen on Spotify, ApplePodcasts and Stitcher

Video Version:

Why do some stocks have pull-backs?

As simple as it sounds, the answer is this:

Stocks don't move up like elevators.

There are many awesome stocks that are consistently in an up-trend that have occasional pull-backs.

*Note: this is DIFFERENT from a stock that does not have a consistent pattern that starts to go down. This is also DIFFERENT from an up-trending stock that has broken it's pattern and now is heading down.

How do you tell the difference?

Up-trending stocks are in what we like to call the "winners circle". They are headed to the upper right-hand corner of the chart.

To be able to detect patterns on the chart, you need to know how to read them.

Here are some resources to help you learn how to read stock charts:

1. Free "Stock Market Starter Pack" (free PDF download) - Click here

2. Free 1-hour "Get Started in the Stock Market" Webinar - Click here

3. Premium "Foundations" course that breaks down how to read stock charts, understand the market language, the best tools to use, and so much more - Click here

It's kinda like this...

When we go to the grocery store and see an item on sale, do we think "Oh, something's wrong with it. I am not going to buy it and wait until it doubles the price"

Um, no - no we do not.

So in the stock market, there could be a healthy company and up-trending chart (like AAPL Apple company, for example) that has a pull-back.

For some reason, many traders think there is something wrong with it.

In reality, this could actually be a good "sale".

You just have to be aware you may not buy it one moment and the next moment it starts to go up again. It may go down for a few days before it starts to turn back around.

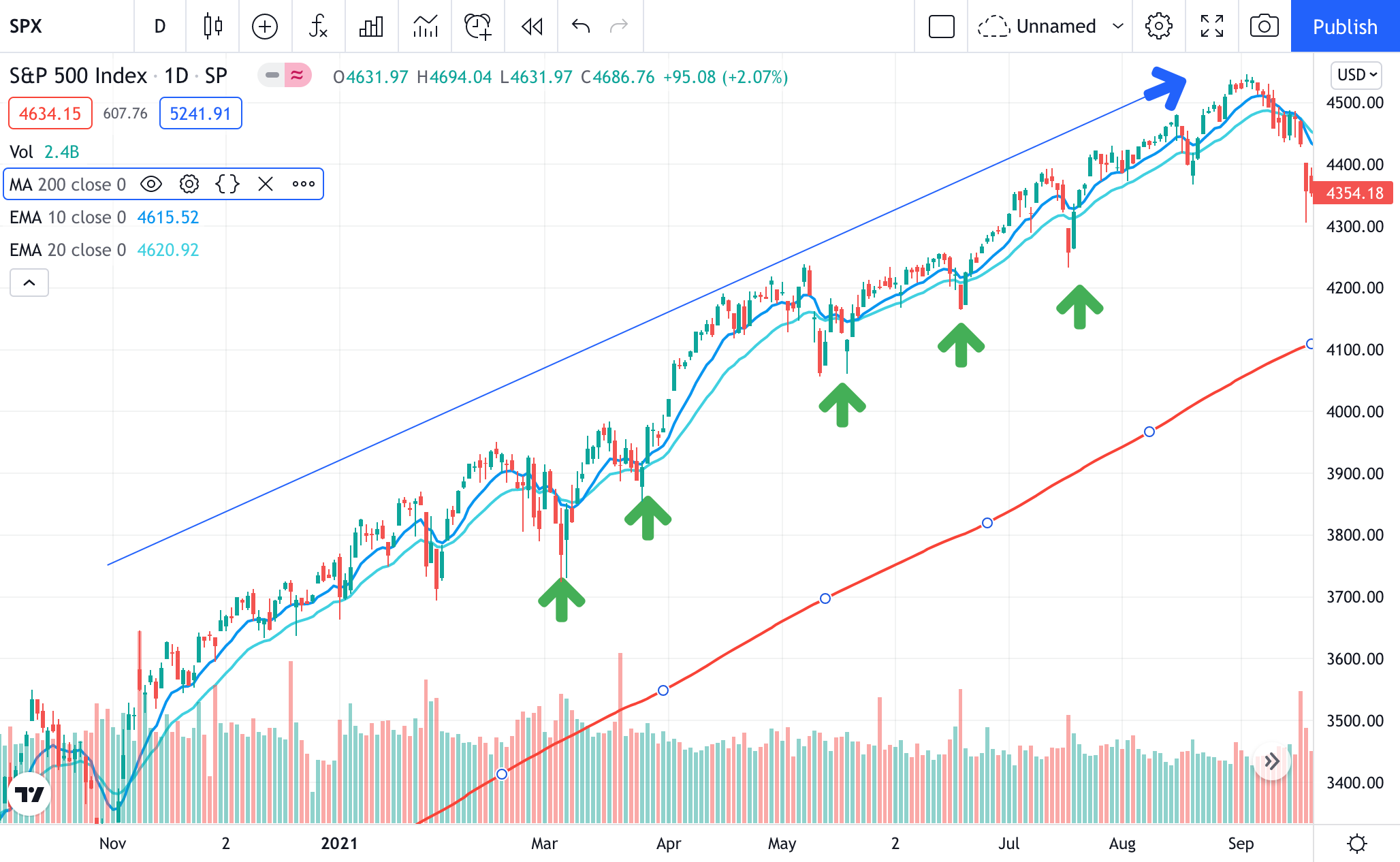

This is an example of an up-trending chart (it's the S&P 500 chart). It's in an overall up-trend, but notice the "pull-backs" or "dips" indicated by the green arrows.

That's why it's important to keep your emotions in check

Trusting that you are making the right decisions when trading can be scary.

What can help with that fear?

1. LEARN HOW TO READ STOCK CHARTS (see above for resources)

You cannot - I repeat:

YOU CANNOT be a successful, level-headed trader without knowing how to detect patterns.

Because when you trade, you aren't trading your emotions, you are trading the chart.

You have to make trading decisions based on facts, patterns, and research.

Not fear.

When you are able to read charts, you can see that there are healthy pull backs with certain stocks, and that it will eventually go back up.

2. GET A COACH AND/OR COMMUNITY

If you are unsure of yourself, you may make bad decisions.

When you have a coach or community to ask questions to, you gain insight and confidence.