Looking to see how taxes work when you are a trader or investor? You've come to the right place.

We are in tax season!

A lot of people don't understand how taxes work as a trader or investor, which is why we are dedicating this whole episode to explaining it.

Let's get into the episode...

Audio Version:

You can also listen on Spotify, ApplePodcasts and Stitcher

Video Version:

A Regular Trading Account

This type of account applies to most traders, whether they're day trading, swing trading, etc... Inside of Robinhood, Webull, etc...

If you're buying and selling stock or options, this applies to you.

You should be asking yourself:

Am I paying short-term or long-term capital gains?

Short-term is any stock or security that you hold under 12 months.

IRS will consider this short-term capital gains, where long-term is any stock held for 1-year or longer.

This is how you are taxed as a trader.

You are taxed as "ordinary income", which means this income will be tacked onto what you make as a job.

For example:

If you make $50K/year from your job, and then you also make $10K from the stock market, they will tack it on to equal $60K as ordinary income.

It's as if you made this much from your job this year, that is the easiest way to think about it.

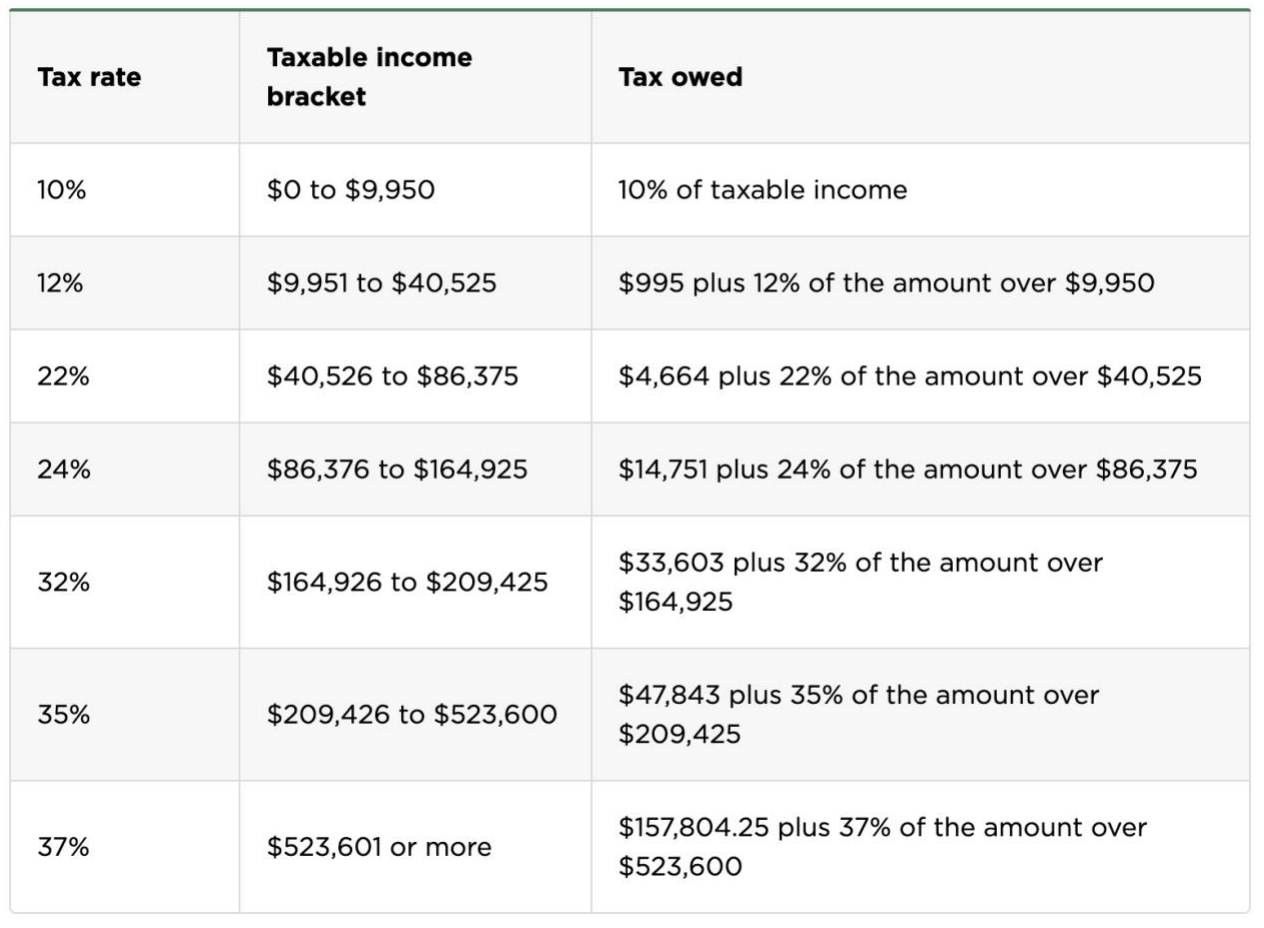

But they will tax it under these rates:

1. Short-term tax rates

2. What you're filing under (single, married filing jointly, etc...)

3. How much you make annually

That is how the bracket can change.

So you need to find what range would apply to you based on your filing status.

Let's use an example of someone filing as a single person using the same numbers before:

As someone who makes $50K/year, this puts you in the 22% tax bracket. Meaning that $10,000 you made in the stock market, 22% will be given to the government.

If you make enough from the stock market to put you in another tax bracket, you will then be taxed accordingly.

For example if you make $50K from your job and then another $50K from the stock market, you will now be taxed in the $100K income bracket.

To help, check out these charts below:

Short-term capital gains tax:

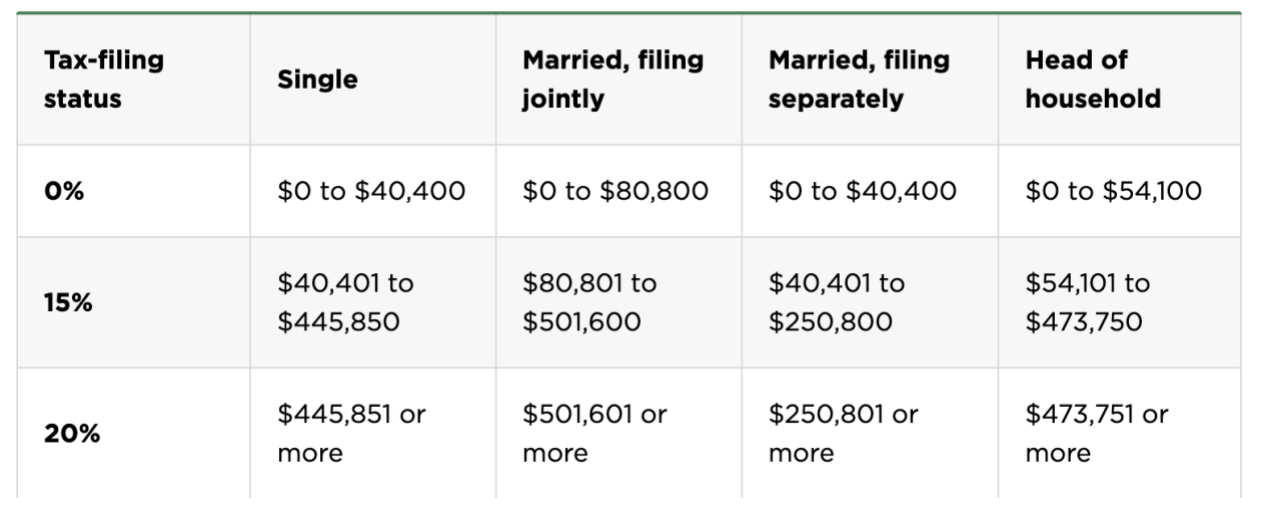

Long-term capital gains tax:

*Always check with your tax professional to ensure accurate and up to date rates

You can see here that sometimes its better to hold some trades long-term in order to get long-term capital gains tax instead of short-term.

*There are no ways to avoid taxes.

We get this question all of the time... "how do I avoid tax when trading?"

It's simple: you cannot avoid taxes or the IRS.

What happens if you lose money?

You can only write-off up to $3,000 of a loss per year.

If you lost more than that, you can do a "carry-over" which means you can carry over that loss into the next year and claim another $3,000.

If you carry forward a loss and then make more than that in the following years, you will only pay taxes on the difference.

Qualified Retirement Account,

Traditional, Roth, or Rollover IRA

This could be a 401K or if its with your company it may be called a 403B.

Money you put into these plans go into it tax-deferred.

Meaning your money comes out of your check and into the account before its taxed.

As you invest in that account and if it grows, you are not taxed until you start pulling that money.

They expect you to make less at retirement which may mean you are in a lower tax bracket and therefore owe less tax on this money as you pull it out.

I hope this is helpful.

If you have any questions about taxes, please speak to your tax professional.

If you have any questions about getting started in the stock market, email us at info@thebrownreport.com.