When You Start Trading, You Need to Know Your Risk Level & What You're Optimizing For

All too often we see new traders jump in because they want to get started in the stock market, but they don't take the time to analyze what type of trader they want to be.

There are different risk levels and different ways to optimize your trading style...

Let's get into the episode where I break down how.

Audio Version:

You can also listen on Spotify, ApplePodcasts and Stitcher

Video Version:

What Are You Optimizing For?

It is key to find what you are optimizing for with your own personal account in the stock market, because then you know what types of strategies you can handle and should do in order to grow your account.

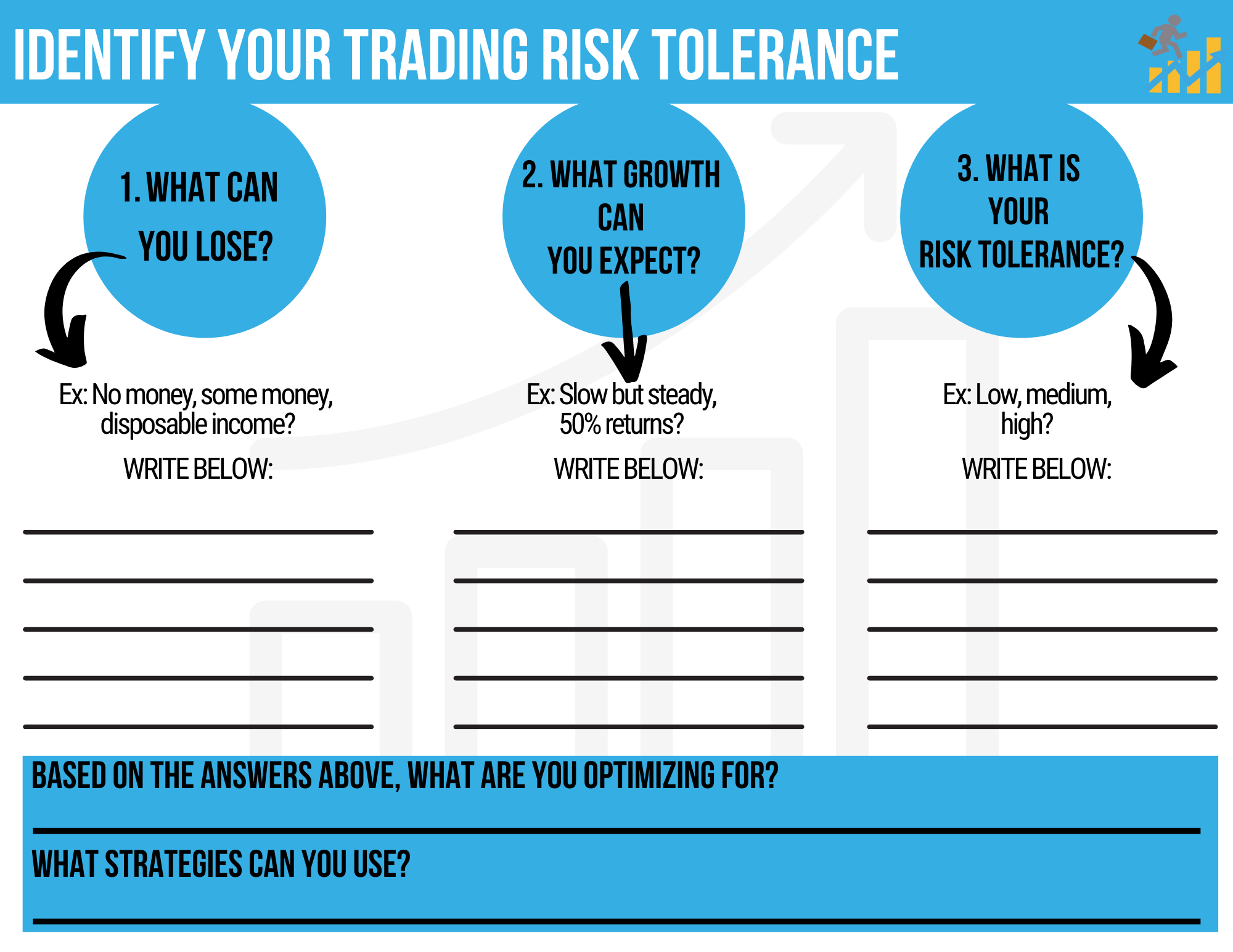

In order to understand what you are optimizing for, you need to ask yourself these 3 key questions:

What can you lose?

What growth can you expect?

What is your risk tolerance?

Let's dive into these questions with more detail with different scenarios...

**Follow along with our Free Download to help you discover your risk tolerance and what you're optimizing for. CLICK HERE to Download for Free. **

"I can't afford to lose any money"

Let's start with this scenario - let's say you are someone who has a small account and can't lose anything in that account.

1. What can you lose?

A lot of people can't afford to lose any money. And if you are someone who depends on every dollar you make, then it may not be a good time for you to start investing, because there is always risk.

If you still want to trade, then that leads to the next question:

2. What growth can you expect?

In this case, you should expect very slow growth. Most people say they want to double their account... But if they can't lose any, slower growth should be expected because you can't take any risk of losing.

Which brings us to...

3. What is your risk tolerance?

Then it's very low. You should make low-risk trades.

You're optimizing for SAFETY and not winning, but just NOT losing anything.

You should be looking at buying stock, mutual funds, ETFs, investing in your 401K, etc.

"I can possibly lose some money"

Let's dive into the next scenario...

1. What can you lose?

Some have a few grand they can lose and still be absolutely fine, they will be able to pay all their bills.

2. What growth can you expect?

If that's you, then you can expect medium, consistent growth. You aren't playing so safe that your goal isn't not to lose but you also aren't trying to double or flip your account. You could take $10K and make $1K a month.

3. What is your risk tolerance?

Then your risk tolerance will be medium - you can lose some but are really looking to protect yourself to get consistent growth.

Strategies you could do: potentially low-risk, deep in the money option trades with plenty of time. Then you are using options which are a lower cost than owning stock and also giving yourself enough time to lower your risk. You can start doing things like covered calls, spreads, etc.

"I have disposable income"

Let's dive into the last scenario...

1. What can you lose?

Some may make more than they spend. They could have an annual income of $100K but only spend $60K a year, meaning they have additional income they do necessarily need to live off of.

2. What growth can you expect?

Now you can start looking at larger returns because you can take on more risk. You are looking at 50% returns, etc.

3. What is your risk tolerance?

Then your risk tolerance will be high - of course you will have strategies in place to protect your account but you are now optimizing for growth.

Strategies you could do: Weekly options to catch momentum from news or earnings season.

Once you know your risk level, you can now adjust your expectations

In each category there are strategies you can do to limit risk and adjust what you're optimizing for.

You can also optimize for learning.

Right now you may not even know what risk level you can tolerate because you don't know the market well enough yet.

That's okay - your goal should be to optimize to learn.

If that sounds like you, I invite you to check out Power Trades University.

We have education to help you learn your risk level, and strategies for every single level of risk.