Have you ever heard this before: “The Stock Market is confusing and it takes a lot of time and money to get started”?

Well, that’s what most people think.

But the TRUTH IS…

There has never been a better time to get involved with the Stock Market than NOW.

Investing is simpler than ever to understand, thanks to resources like YouTube, and it’s easier than ever to get involved and start profiting today, thanks to the power of the internet.

The Stock Market is the Number 1 way to create wealth and have your money work for you instead of you working for it.

Which is why I am going to show you the roadmap I used to make my first $1,000 in the stock market and how it’s 100% possible for you to do the same.

The way we earn a good living today is changing rapidly. Gone are the days where you had one good job that you were able to stay at for 40 years and collect a pension.

In this day and age, to support yourself and your family, most people are working two jobs to make ends meet, then they are asked to contribute to their 401K for retirement, which is just a fancy term for “invest in the stock market”. This proves once again that all roads lead back to the stock market and that it’s more important NOW more than ever to learn about how it works and how to make it work for you.

With a laptop and a high speed internet connection, you can skip over the sales pitch of some financial guru and go straight to the market and buy stocks that are moving and buy good companies that you probably already do business with, like Apple, Google, Facebook, Tesla, Target, and more.

Get a head start by downloading my “‘How to Get Started in the Stock Market” Starter Pack. Discover the first three essential steps that you need to accomplish to get started.

So maybe you haven’t gotten started before because you’re thinking:

“Shouldn’t I just hire someone to do this for me?”

Or…

“Isn’t this going to take a lot of time that I don’t have?”

Or…

“Okay okay, even if I had the time, don’t I need a ton of money to even make it worth my while and see any real profits??”

Let’s tackle these questions one by one…

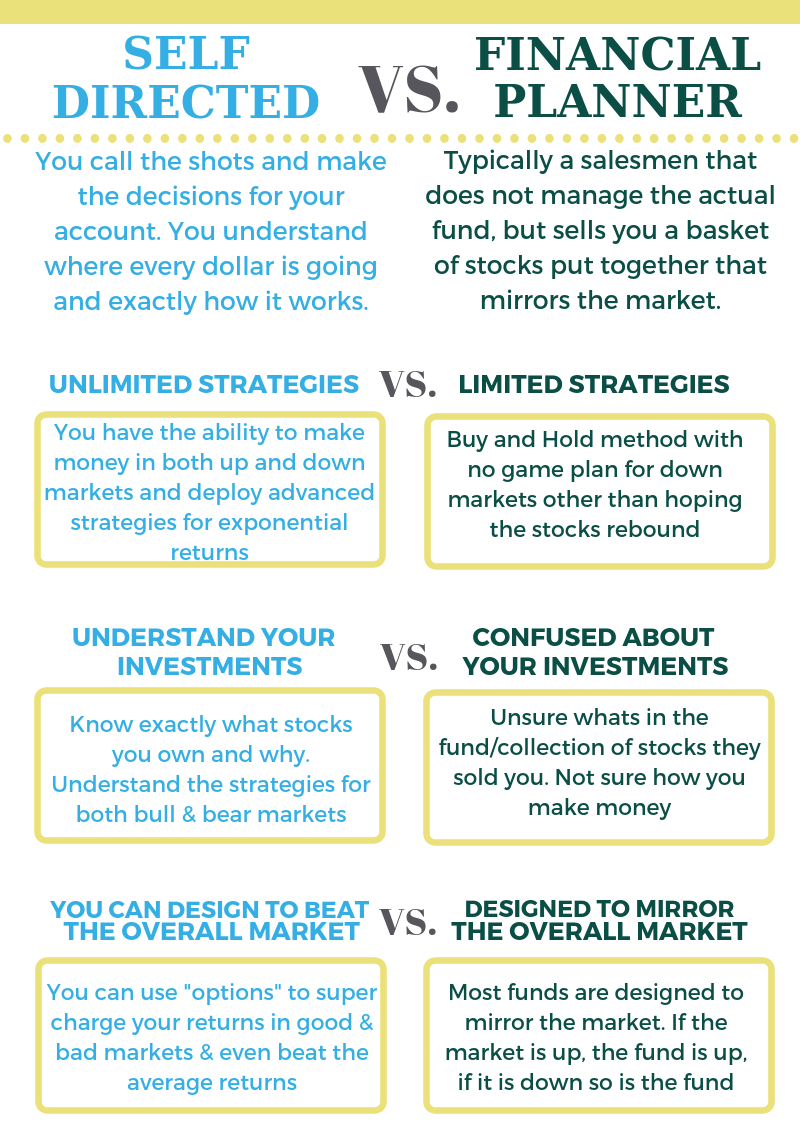

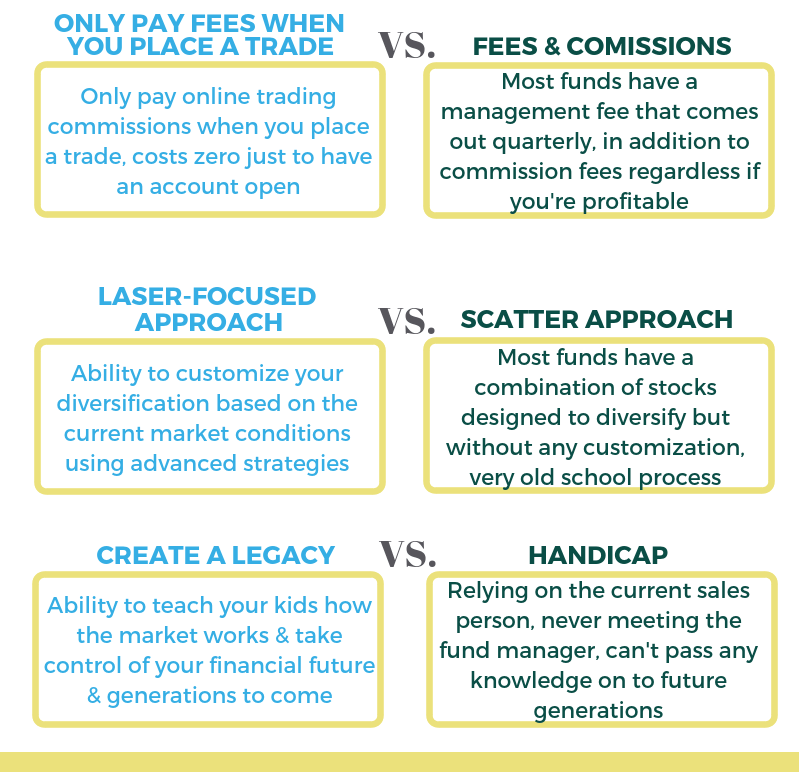

First, let’s explore how hiring a “typical” financial planner works

Typically, a financial planner will sit down with you and ask you five basic questions:

“How old are you?”

“When do you want to retire?”

“How much money do you need to retire/live a comfortable life?”

“How much money do you have set now aside to invest?”

“How much is that money making you now?”

From there, the job of a financial planner is usually to sell you on bringing your money over to their fund or firm where they get a percentage of the assets under management, and then they move on to the next client while you make monthly contributions and still have no idea how the whole thing works.

Oh, and you’ll get some statements in the mail every three months that you won’t know how to read.

A financial planner usually has to move on and build a big book of business in order to make a living… so the reality is they don’t have time to help you manage anything less than $250,000. (At least that was the number the last time that I checked with some of the more popular financial institutions.)

Do you really want to turn your money over to a salesman and still not actually understand how it all works and how to make it work for you and your family?

How’s that been working out for you so far?

“But isn’t this going to take a lot of time that I don’t have?”

So maybe you’re thinking, “This sounds great, but won’t this take a lot of time to learn how to do this on my own?! Besides, I work a full time job, wont I have to quit to do this?”

Let’s talk about this for a second…

Do you remember the first time you learned how to ride a bike and how long it took?

I’m guessing that it went something like this:

Phase 1.) Your parents put training wheels on the bike to help you get a feel for what riding a bike is like with little risk of you falling over and hurting yourself. (Notice I said “little risk”, not “no risk”.) You still could tip the bike over with training wheels and get hurt.

Phase 2.) They put elbow pads, kneepads, and a helmet on you so in the even of when you did fall, you didn’t get hurt “as badly” (notice I didn’t say “if you would fall but “when you did fall”).

Phase 3.) After some practice, they took the training wheels off but STILL left the protective gear on you. And after falling a couple of times, you finally got the hang of it.

Now I’m willing to bet this didn’t all happen in one day.

But once or twice a week, you went outside for a few hours and you learned, tried, and applied, and eventually learned how to ride.

My guess is, as a kid, it was worth it to learn how to ride that bike… think of all the fun times zooming up and down the block.

In essence, you can learn how to have your money work for you in the same manner and with similar effort you put in to learning how to ride a bike.

I would say that:

You must be willing to commit a minimum two hours a week to learning this industry.

Wouldn’t you agree that as a kid if you could set aside 1-2 hours a week to learn how to ride a bike, then as an adult it’s important to set aside 1-2 hours per week to learn how to ride the money train?

Keep reading because…

…later on I’m going to show you how you can learn the stock market and ride the money train with training wheels on and how to practice with them until you get the hang of it on your own.

Now how long exactly is the learning process?

Well, much like each kid learning how to ride a bike, it varies. You may have learned to ride that bike in one month, two months, or it took you all summer. The point is, with a little practice and time, you eventually learned and mastered riding a bike.

And more importantly, the skill has stuck with you a lifetime and paid dividends. You even know how to train and pass the skill down to your own kids and that alone is priceless.

Let me ask you two questions:

Q: Have you sat down and watched Netflix or any TV shows for more than two hours in a week?

Q: If you added up all the time you spent on social media this week, could at least two hours a week be spent learning something that will help you take control of your financial future for years to come?

My bet is that you’re saying, “HECK YEAH it’s worth it to find two hours a week”.

Two hours a week is roughly how much time I spend.

I typically spend about two hours researching trades and looking at stock charts along with my students inside of Power Trades University were I share all my findings of stocks that are moving and the option strategies that I’m looking to implement.

“Don’t you have to have a lot of money to get started?”

It’s actually best that you get started with no money.

But… “It takes money to make money” – haven’t you heard that one before??

So maybe you’re thinking, “Maybe I need to save up some money FIRST and then I’ll learn how to invest”.

STOP IT RIGHT THERE

Don’t you know why most lottery winners go broke??

After all… since they won the lottery… shouldn’t they be the next billionaires since they have money now to invest?

Most lottery winners go broke because the lack of money was never the real problem.

The lack of knowledge of how to invest and manage money was always their true problem. So when they ran into a big sum of money they did what they always knew how to do… Blow it.

They go shopping, buy depreciating items like big cars, jewelry, throw big parties, maybe even buy a ridiculous big house where the monthly maintenance and property taxes will eat into their wealth and eventually force them into foreclosure.

Still not buying it?

Well go ask Mike Tyson, Evander Holyfield, MC Hammer, and the countless other sports figures and movie stars who made a ton of money who eventually went broke and found themselves staring at foreclosure, bankruptcy, and back taxes.

They didn’t win the lottery, but the main problem is all the same. They lacked the financial intelligence of how money works and how to make it work for them.

The money is found in knowledge.

If you had $10K TODAY to invest, would you know what to do with it? PROBABLY NOT.

You would have to acquire the knowledge.

So if all roads lead back to knowledge, its best to get the knowledge FIRST before you blow the opportunity when it comes knocking at your door.

I know when I first started out investing, all I would hear about is money moving into this stock or this trend is ending and a new one is beginning over here. It was a mystery to me what they were talking about on these stock charts.

Fast forward to present day, after looking at thousands of charts and teaching thousands of students in Power Trades University how to read charts and to spot trends, I have learned a thing or two that I am going to share with you today.

And the best part about being an investor these days is when you open your free trading account, you get access to some of the best news and research tools.

Did I mention that most of these tools are free which will allow you to spot trends and determine the best times to buy and sell almost any stock. I’ve even put together a video on how to open your first trading account, which you can check out here.

Maybe you’re thinking, “I already have a Fidelity account where my 401K is held, I’ll just use that”.

Perhaps you already have most of your money in a checking and savings account with a local bank or credit union and you will go there and see what investment accounts they offer.

Here’s why you don’t want to use your 401K or regular bank accounts

“I’m sure they have all the tools I need, right?” WRONG.

You see, the bank specializes in taking your money, conveniently placing ATM’s around town to collect fees and giving our home loans and credit cards to collect interest.

401K companies specializes for the most part in dealing with your corporate employer and setting up big contribution and match plans and putting those into a predefined fund that you cannot control which stocks are included in them.

An online broker specializes in self-directed investing and trading.

Online brokers also offer easy to use tools such as free stock charting software, quotes on stock prices, access to option chains and a whole lot more to make self directed investing super easy for you to do from the comfort of your home or smart phone.

“Now what about the fancy tools I see you use in your videos or that I see on TV flashing all the signals and colors??”

I thought the same thing, “Don’t I need all that flashy stuff??” Such as:

- A new computer with a super duper fast processor

- Two computer screens and some snappy fancy pants software

- How about a new wireless keyboard, mouse and desk

NOT YET.

Keep it simple, just get started and open a free account. The free tools are more than capable of setting your financial boat out to sail.

I’ve also found you won’t appreciate or know how to use some of the fancier tools until you have mastered the free tools and made some money to justify needing more comfort, speed and convenience.

Pick up my beginner Stock Market Starter Pack which will show you how to craft a financial game plan and which two brokers to open your accounts with first.

So you’re ready to take control of your financial future…

To have money work hard for you for a change…

To feel confident discussing stocks and investing…

To get excited knowing you have a financial game plan…

To finally get ahead in life and not have to depend on anyone to give you a raise…

BUT let’s be honest.

Your mind is probably playing tricks on you right now.

You’re thinking, “Can I really do this? Can I really be successful taking control of my own financial destiny? What if I lose all of my money – what will my friends and family think of me?”

I get it. I felt that way, too, and had all of the same questions.

But after making my first one hundred dollars I knew I could make my first thousand.

After I made my first $100,000 I realized that if I could do this then anyone could do this.

I couldn’t believe the schools were not teaching this, which is why I started helping thousands of people get started through my own programs inside of Power Trades University.

In the early stages I had to work through my own mental baggage. I too thought this was only for the super rich and those born into privilege.

This is why I love helping others get the knowledge that they too thought was only for the rich.

I want you to realize that you are just as deserving as anyone else to have your money working hard for you instead of you working hard for it.

I want you to realize that this game is not about “if it works”. It’s about:

- Who has the information about how it works

- Learning how to make it work for you

I know you want The Dream…

The dream car, the dream house, the dream vacation…

- To be able to pay off debt and live a debt free life

- The financial freedom to donate as much as you want to your church, charities of choice and community without worrying about your own personal finances

- The freedom to travel, the freedom to not wait until you’re 80 to start finally living the life you deserve

- And I know you’re tired of being on the outside looking in. Worrying about how you are going to provide for your family today let alone leave a financial legacy for tomorrow

- You want to be able to stop playing small and play big like you know you can

But you’ve probably fallen into the emotional roller coaster of an investor. Does this look familiar?

I have been through these peaks and valleys. When I first got started I invested $500 in Sprint PCS stock because that’s who I worked for. The stock was $5 a share and I figured if I could buy 100 shares and the stock just moves .50 cents I would make my $50.

But guess what happened the moment I bought at $5.00, it was like someone was standing over my shoulder and said “ He’s in! Now send the stock down”

The stock basically fell down to $4.00 and I felt like a failure. Then when the stock returned back to $5.00 I was like “Here we go, I’m going to finally make my .50 cent when it goes to $5.50!”

But what happened next would be the best thing that could ever happen to me. The stock fell again down to $4.00 and that’s when I realized the stock was moving between two price points and if I drew that out on a chart it would be called a “channeling stock”.

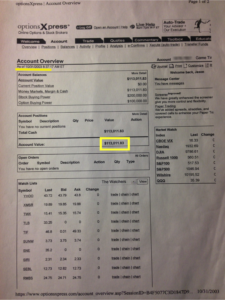

You see, that one experience led me to chart reading and eventually turning my $10,000 student loan into a six figure trading account once I learned how to spot patterns in stocks and the market.

You see, that one experience led me to chart reading and eventually turning my $10,000 student loan into a six figure trading account once I learned how to spot patterns in stocks and the market.

Yes, this is my actual trading statement from 2003 that shows my $113,000 account.

I know crazy right?

The best part about all of this is that you don’t need to have a lot of money to get started.

And you also don’t have to go into debt by going to college and taking out student loans to learn this industry.

What do you need to get started?

A desire to learn and a commitment to show up and take the first steps toward getting the education about how this all works.

So if you’re ready to have your money work hard for you, ready to have the confidence that comes with having a plan and the knowledge to generate money on demand from the stock market as if you owned your own money tree, then I want you to get started taking the first steps toward making your first $1,000 from the stock market…

Ok, are you ready? Let’s dive in…

Here’s what you need to do first to get started on the right foot:

Milestone #1

Understand how much money you want to make and what percentage returns you will need to earn.

In the Free Starter Pack PDF, I show you how to create not only your yearly plan, but also your monthly plan. I also help you do the math to understand exactly how much you need to get started.

Milestone #2

Understand the three most popular stock chart patterns.

In that same PDF, I’m going to walk you through the three most popular trends. I want you to print it out and study them to make sure you understand what they are and when they appear.

Milestone #3

Open a brokerage account and practice trading account, to practice trading the three most popular chart patterns.

I’m going to show you how to open up a brokerage account and how to practice without ever putting any real money at risk until you have made at least 10 trades and you are right 7 out of 10 times or net positive (meaning even if you’re wrong more than right you still made more money than you lost)

Ok so you’re ready to make your first $1,000 in the stock market right…

I just laid out a blue print that will help you get started in your journey towards your first $1,000 and so much more.

You see most people make the mistake of saying they just want to make “some money” well it’s only when you have a specific goal, matched with a game plan tied to a specific time frame that it will move from a dream to reality.

So if you’re committed to first writing out the plan, if you’re patient enough to learn the three most common chart patterns and smart enough to practice first just like a pilot in a flight simulator before he ever fly’s a real plane…

…then download our Free Stock Market Starter Pack below.

As you take these simple steps I want you to image 90 days from now:

Just imagine getting up in the morning and logging into the computer and checking your investment account…

- You’ve spotted several stocks that are starting to form that predictable, repeatable pattern that you learned about

- You placed a trade to purchase the stock at the best possible price before it starts to sky rocket to the moon

- You feel confident about your decision to purchase and your risk reward ratio

- You come back in 30 -90 days to realize you’ve made $1,000 or more without physically working for it

- You smile as you go to work (or not) realizing with this knowledge and new found skill you have changed your family’s financial future forever and for generations to come

Here you are looking in the mirror and you love the person you see staring back at you. YOU DID IT. You took control.

You realize it wasn’t that hard, you just had to learn what the wealthy knew and you knew you could be wealthy, too.

Now you are the go to person in your family when people want to understand how the stock market works.

Your kids don’t have to look any further than to mom and dad to understand how money works and how to have it work for them.