When stocks start to fall, is it possible for everyday ordinary individuals to profit from it? In this Put Option Case Study video, I am going to walk you through a real live trade in my personal account. I’m going to reveal how I personally made an 84% return in 3 days and a 34% return in a 24-hour period.

People always ask how realistic is it to make 10% a month in the stock market. Well if you learn how to trade options, the possibilities increase drastically since you can profit from the downside of a stock falling.

As a disclaimer, this does not mean you will earn this type of money, I’m merely showing what’s possible with the right education, a little discipline and some time.

Let’s break down two personal trades I made – one where I made a 34% profit in 24 hours and the other where I made 84% in 3 days.

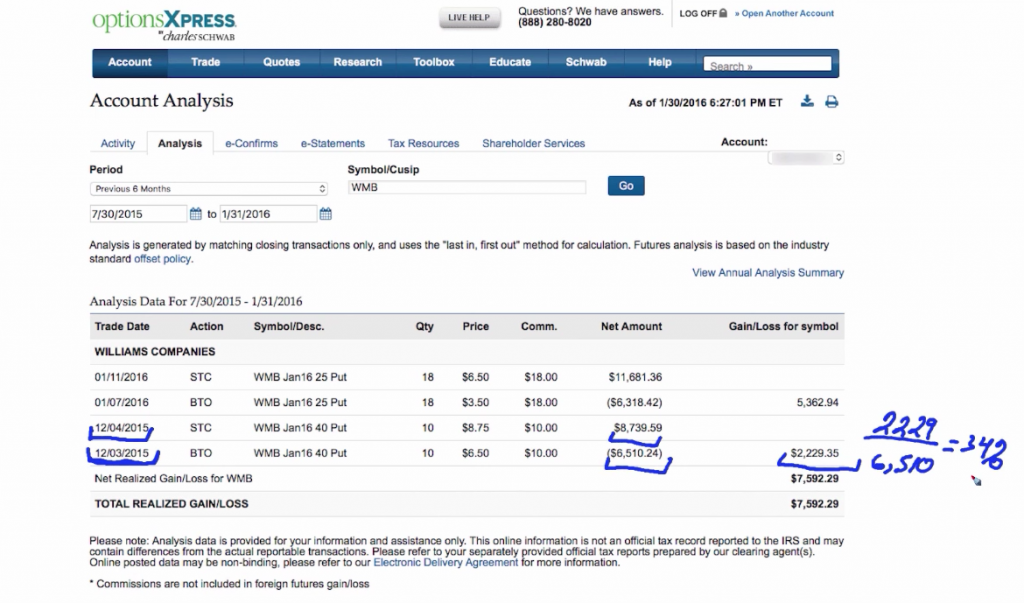

34% in just 24 short hours

I entered the trade on December 4th, 2015, as you can see below. I bought to open (BTO) at $6,510.24. Right above it, you can see where I exited the trade on December 5th, 2015, just 24 hours later! I sold to close (STO) at $8,739.59.

But how did I see it coming?

Let’s break it down. Right before I entered the trade, I posted in Facebook on our private Power Stock Options Group (for those who have purchased the Options Explained course) to watch WMB. Why? Because it was a downtrending stock. And, as an option trader, I get really excited about down trends. Knowing how to trade options is the only way to make money when the stock is going down.

If we look at the chart below, we can see that on December 3rd there was a DOG near resistance. The next day, on December 4th, it showed resistance. So I caught the bearish sell-off, took the money, and ran. I could have made more, but I wanted to do a case study to show the power of options, even in 24 hours.

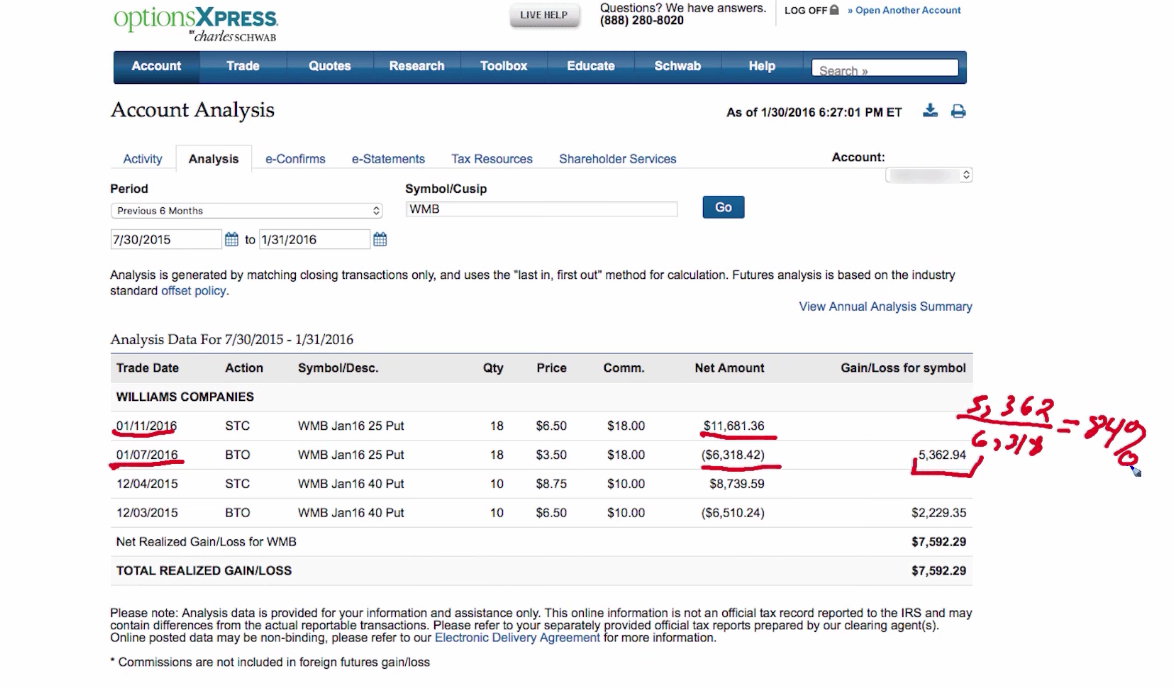

84% in 3 days

Let’s see how I made a bigger profit with the same stock, about a month later. I entered the trade at BTO on January 7th, 2016 at $6,318.42. Under 4 days later, on January 11th, 2016, I sold it (STO) for $11,681.36. Which made me a nice return of $5,362.94. How much of a percentage is that? You guessed it: 84%!

So how did I see it coming?

Again, I posted on Facebook in our Options Group to check out WMB on January 7th, before the stock market even opened.

I saw that the DOG had again fell right at resistance. This time, it fell below the down trending line, so the bottom would be resistance. Already seen this story before, we knew what was going to happen. So by the 10th, I got out. I could have stayed in and made a bigger profit, but I am a big believer in not wanting to get greedy.

Stock traders only have a 1 in 3 chance of making money according to the three ways a stock can move. However, option traders can not only make money if a stock is going up, but they can also make money if a stock is going sideways and down – giving option traders a huge advantage to be able to profit in any market. Check out my free intro to options webinar and blog post here.