Is Now the Time to Jump In and Buy Tesla Stock?

Tesla (TSLA) has been on a spectacular run recently, climbing about 25% over just the last 10 trading days and peaking at $260 per share. If you’ve been watching from the sidelines, you’re probably wondering: Am I too late to the party, or is there still a good opportunity to buy Tesla stock now? I'll break down why the answer may be different depending on your time horizon and what type of investor/trader you are.

What’s Driving Tesla’s Stock Up?

The recent surge can be attributed primarily to Tesla's impressive delivery numbers. Tesla exceeded Wall Street's expectations by shipping 444,000 vehicles, surpassing the forecast of 438,000. This seemingly small margin was enough to spark a run-up in the stock price.

Interest rates have stopped climbing and may soon start to drop. Lower interest rates generally lead to increased car sales, as financing becomes more affordable. If Tesla can surpass delivery expectations in a high-interest-rate environment, its potential in a lower-rate environment becomes very promising.

In addition, Tesla's launch into the truck market with the Cybertruck adds another revenue stream. Even though specific sales numbers for the Cybertruck haven’t been disclosed, it's clear this new category could siphon sales from traditional truck manufacturers like Ford and General Motors.

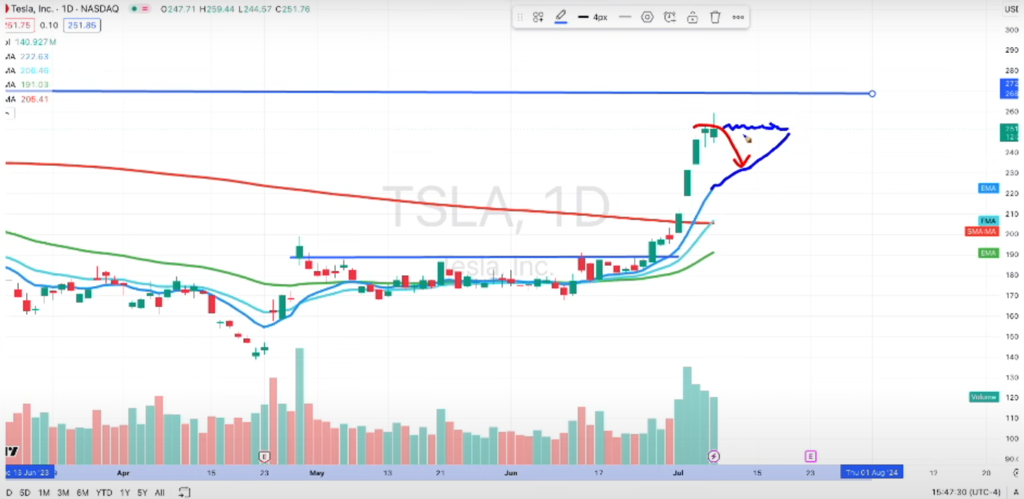

Technical Analysis: Is There More Room to Run?

When we zoom out and look at Tesla's stock chart, there are clear indicators of a breakout. The stock has unsuccessfully attempted to break through previous resistance levels multiple times before finally succeeding following the delivery announcement. Currently, the stock has room to run up to around $406 or $407, another 150 points from current levels.

However, after taking a closer look, we are revealed with some cautionary signs. The stock is approaching a resistance level at around $272, and the current buying momentum appears to be waning. Traders might notice declining volume, which suggests dwindling interest in buying at increasingly higher prices. Additionally, smaller candlestick bodies and longer wicks are emerging, indicating people are selling into the rally.

Should You Buy Now?

For the Long-Term Investor

If you’re in it for the long haul, Tesla remains a promising investment. The company is not just an automobile manufacturer; it’s at the forefront of several groundbreaking technologies, including electric vehicles and autonomous driving. The long-term potential remains high. Therefore, if you're planning to hold until Tesla potentially hits $400 or even beyond, you may consider incrementally adding to your position as the stock rises or on pullbacks.

For the Short-Term Investor

For those looking at shorter time horizons, it's a different story. Given the signs of losing steam, it might be wise to wait for a pullback. Ideally, Tesla could pull back to its 10-day moving average or consolidate sideways, allowing time for the moving average to catch up. Either of these scenarios could present a safer entry point for buying the stock.

Final Thoughts On Investing in Tesla Stock

Tesla continues to defy expectations, and with Elon Musk at its helm, you can never count the company out. Whether you’re a trader looking for short-term gains or a long-term investor betting on the future of automotive and technology, understanding Tesla’s current position and potential future movements is crucial.

Now, I want to hear from you. Do you own Tesla stock? Are you a long-term investor or a short-term trader? Did you catch the recent big move? Drop your thoughts in the comments. Let's have a conversation.

Want More Comprehensive Market Breakdowns?

Unlock your potential in the stock market with our comprehensive stock and options trading education platform. Join us to gain invaluable insights, strategies, and tools from experience traders. We are designed to help you trade successfully. Whether you're a beginner or an experienced trader, our courses and coaching cover everything from fundamental analysis to advanced trading techniques. Take control of your financial future and start making informed trading decisions today. Click the button below to learn more: