...And how to break through them so you can start becoming a confident trader.

Recently, I asked a question on my Facebook page.

I asked: "When you think about investing, what's the first thing that comes to mind? I feel like ____"

Let's get into the top answers I got, because I know that many new traders out there may be feeling the same way.

*Be sure to listen or watch until the end to see how you could possibly get one of our courses for free*

Audio Version:

You can also listen on Spotify, ApplePodcasts and Stitcher

Video Version:

1. "I feel like I want someone to trade/invest for me, so it won't be so hard"

I think back to my journey to investing. I felt the same way when I was about 18 or 19 years old.

I thought that it must be too complicated.

So what I did is take $2,000 to a well-known bank to invest that money for me. After all, these financial advisors were the ones who went to school and had a degree, right?

Well they lost $1,300 of my money in a year or so.

And I thought "Well I could have lost my own money!"

I thought the only option was to take money to those who actually knew what they were doing...

But really, the stock market is not that hard.

BUT, most of the people who explain it are in fancy suits, use big fancy words, and make you feel like you were stupid if you didn't understand.

Nowadays, there are more information on Youtube and people are starting to share financial education in every day ordinary language.

You just have to learn a few things to understand the language.

No one will care about your own money like you do.

It's harder watching someone ELSE lose your money... especially if you don't even understand how they did it.

2. "I don't want to have to sit in front of the computer and pay attention all day"

I know I felt the same way when I first heard the concept of "day trading".

Because that is what they do - sit in front of the computer all day, look at charts, etc...

I tried it! I was pretty good...

BUT now I only do that once in awhile.

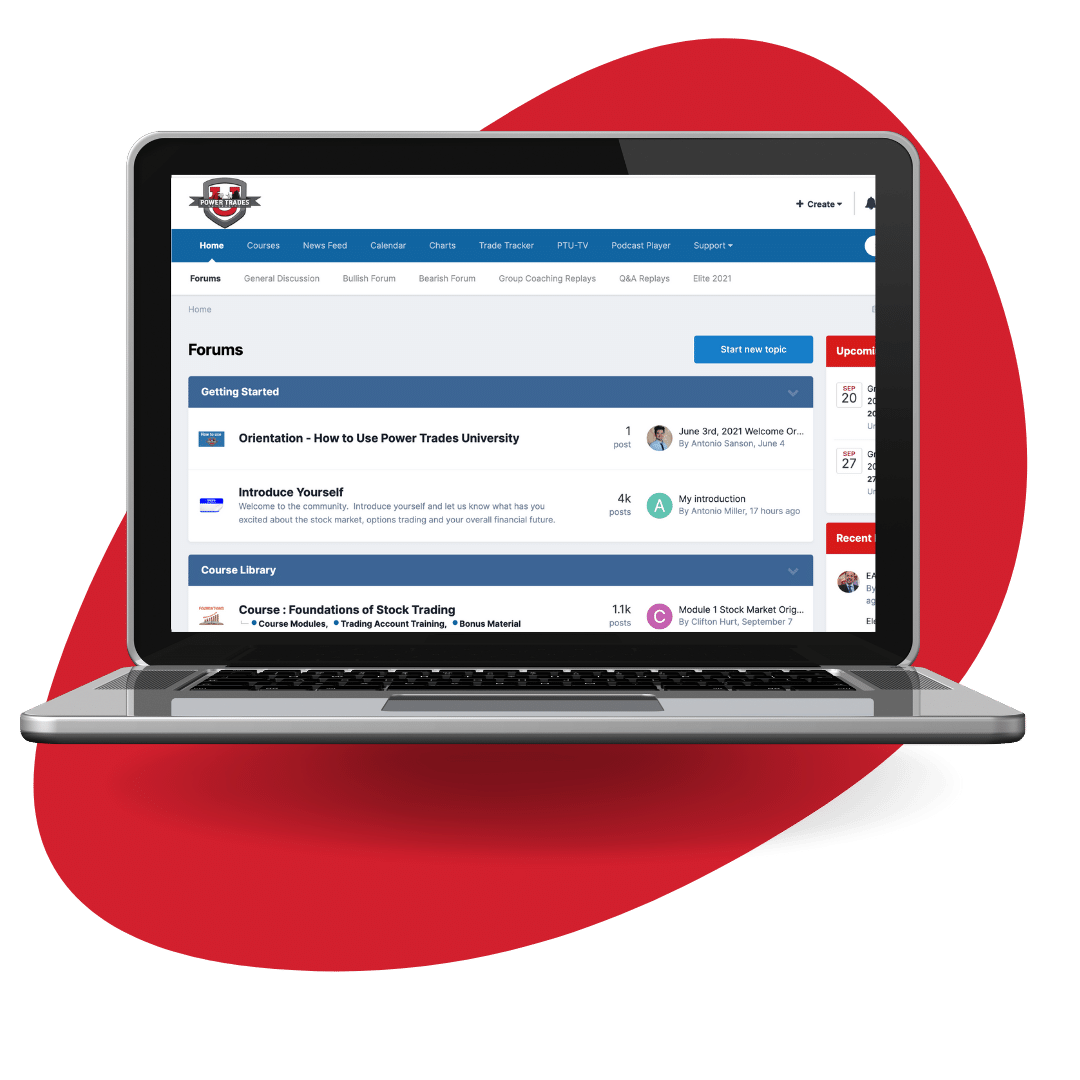

Now I mainly focus on what we developed and call the "Power Trade" way (inside of Power Trades University).

This method means you do NOT sit in front of the computer all day, rather, you find a few really good and POWERful trades that brings in the most profit.

We use alerts to indicate if something is going right or wrong, and then just walk away from the computer.

We don't watch the trade all day long.

We give it enough time to do what we think it's going to do, and unless an alert goes off, we don't need to check it all the time.

The whole goal that I believe in:

Not to have a second job within the stock market.

You already have that.

It's about learning how to make your money work for you... Because it can do that while you're already at work.

3. "I feel like I want someone I trust to help me"

The word "trust" implies that you want someone you already know to help you, and also to ensure that they know what they are doing.

And you believe they won't take advantage you.

When I first started trading, I used to think "trust" with respects to finances meant that someone who was educated and had a good job could be trusted.

However, as I continued growing up and learning, yes they check the credentials boxes but that doesn't necessarily mean that I personally will trust them as my financial advisor.

One of the conflicts of professional advisors is that often times they are paid based on how many accounts they open.

So they don't necessarily always have the deepest intentions to help you.

Don't confuse their duty with trust.

Trust means they are willing to put your needs before theirs.

Trust means you know them well enough, not blind trust.

And now with Youtube and social media, we have so many influencers out there and you may assume if they have a lot of followers, they must know what they are talking about.

How do you unpack that trust?

Here is how we try to build trust within our community:

1. We share winning trades as well as losing trades, being transparent with good and bad

2. We try to share the good side of this lifestyle, as well as some of the stresses that come with it

3. Inside of Power Trades University, we look for real trades, real time live with the students so we have years of trades. Most of them have gone right, and some have gone wrong. But you can go back to each and see what our analysis was of each trade and if it was correct or not.

What is it that YOU need to trust someone?

4. "I feel like it's time-consuming and high-risk"

What do you define as "time-consuming"?

I always say if you can dedicate at least 2 hours each week to this industry, you can potentially have some level of success.

I think about when I entered college - I committed four years to an industry I wasn't even sure I was going to like, or if it would ever make me more than $40K a year.

Now that is WAY beyond 2 hours a week and didn't near have the potential of the stock market...

And what it now has done for me, such as allowed me to pay off our house and live debt-free.

No way work would allow me to make that kind of money that quickly.

Are we willing to put time into something that has that type of potential?

I am not guaranteeing anything here, but wouldn't you want to put some time into finding out if it could work for you?

Now let's tackle the second part of the concern: "high-risk".

High-risk is tied to lack of knowledge.

If you put a 10-year old in the drivers seat of a car, thats high-risk.

There is always risk when driving a car, but if you were taught by someone, went to driving school, and practiced, doesn't that now lower your risk?

If you have not been taught in the stock market, and are like "I heard about the stock market I'm just going to do it".

Well of course there is risk there.

But if you take the time to LEARN strategies, and then practice them without even putting real money to work yet until you get good, then you lower your risk.

5. "I feel overwhelmed"

Well you probably feel that way if you have never been taught about it.

Think about riding a bike...

When you were young, the concept may have seemed overwhelming.

But when you have someone to help you and train you, and you take the time to practice, you feel more confident.

There's always that kid on the bike who has to pop a wheelie and show off... well, the same in the stock market. People may come in and share huge numbers and brag about their trades, and that can seem overwhelming too.

That's why you need to take the time to investigate and learn from someone who is a safe teacher and see what it really is about.

What do I need to do to come in and not feel so overwhelmed?

Maybe its not to come in with crazy, lofty goals, but more reasonable ones. Maybe its just making a few extra bucks to start and go from there, so each goal is attainable.

So here's what we are doing about it.

We asked you what is keeping you from getting started, and hopefully we were able to start to break down those walls about those 5 reasons our followers shared with us.

But we aren't stopping here.

Here's what I want you to do:

Text me and my team at (313) 251-2260.

Text these letters - "bb"

I am going to give away one of my courses FOR FREE.

For a limited time only.

In this course you will learn the basics about getting started and walk you through some of the things that may seem overwhelming and what seemed overwhelming to me when I first started learning.