Recently, we have been getting this question a lot:

"What's the difference between swing trading, day trading, and investing... and how do I know which one I should do?"

There are so many types of trading out there, you don't want to get "analysis paralysis" and let that keep you from getting started.

So let's break it all down here in this week's podcast episode:

Audio Version:

Day Trading

Day trading is buying and selling a stock, option contract, or asset within the same day.

It can be appealing to some because they think of it as making money every single day.

Trading is the concept of buying something and trading it for a higher price (hopefully).

It's no different from going to a discount store or thrift store and buying a purse and then selling it again for profit. If that happens in 1 day, well you just did a day trade my friend.

Some day traders wake up and have 1 goal in mind:

Wake up and make money in the stock market that day.

The problem with day trading is: you have to be in front of your computer all day because you typically don't know when your trading opportunity will come.

If you are day trading:

You are following patterns on the stock charts, especially daily patterns.

Most of the time you are looking a some type of minute chart, not a longer time frame like daily or weekly.

When you are day trading, you typically don't care as much about the company behind the stock itself and what they do, like you would pay attention to more-so with investing.

You trade something then you're onto the next.

Swing Trading

Swing Trading is the concept of taking advantage of price movement, momentum, or news thats happening for a period of time.

So the difference between this and day trading is that your time frame is longer: maybe multiple days, weeks, even months.

You're looking to catch a "swing" of movement.

For example, Facebook (ticker symbol FB) just announced earnings last week (at the time of this episode we are in the beginning of February 2022) and they had a huge gap down and sell off.

If you are a swing trader, you could have taken advantage if this bearish move or "swing" with a put option.

In this case, you are willing to hold your stock or option longer than a day.

What's similar?

It's similar to day trading in that you are looking for a pattern on the stock chart, that you believe will perceive for a "medium" period of time (1 week - 6 months).

You "swing" into it and then once the pattern is over, you take profit and sell.

However unlike day trading, you likely will be looking at a daily chart verses minute chart.

Like day traders, you may not necessarily care about the company behind the stock you are trading. You more-so care about the movement of the chart and any news you hear about it that could influence a major swing (such as announcing earnings, a buy-out, etc).

Investing

With investing, you care about finding a fundamentally stable and good company.

When you day trade or swing trade, you can do so both to the upside and also the downside to the stock (using put options and other strategies).

However, with investing the only way to make money is if the stock moves up.

You need it to increase in value over time.

It could be your 401K etc but the point is you want it to go up.

If you only know how to invest when stocks go up, unfortunately the market doesn't always do that.

So you need to learn strategies even with investing that will allow you to protect your account from the downside and even make money to the downside.

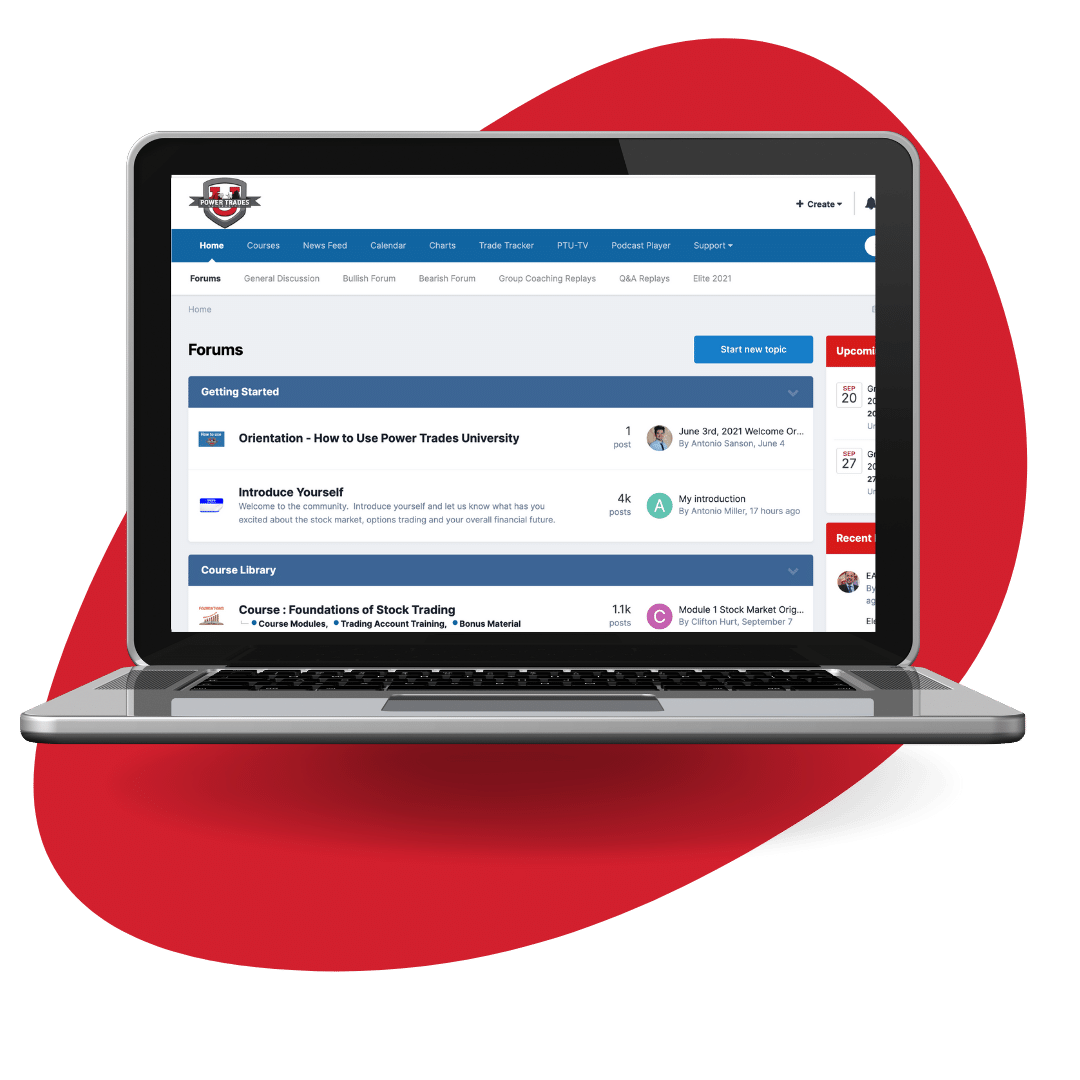

Which we teach right inside of Power Trades University.

If you are an investor, you are looking to invest longer-term, even years and years.

They don't pay attention to the chart every single day like a day trader would.

A swing trader may say "I am in this stock and as soon as it starts to go down, I am taking my money and swinging into another stock"

Where as an investor may say "I am in this for the long-haul even the ups and downs, because I believe over time it will continue to go up"

Based on research, an investor thinks it eventually will have one direction and will take the ups and downs on the way to get there.

What I believe:

What we teach inside of Power Trades University is:

If you treat trading like investing and investing like trading, you will have the best of both world's.

An investor will say, "I don't care whats going on right now with the news about the company, I think it goes up over time."

Sometimes when they do that, investors will ignore a crucial aspect which is what is going on with the chart.

And the chart could actually be telling you, it isn't going up anymore.

It could tell you it is time to take your money and profit, and invest somewhere else.

That technically is "thinking like a trader".

But applying essential chart reading skills as traders, could actually make you a better investor.

There are good companies, but bad times to invest. And that's where chart reading comes to play.

On the other hand,

When you look at most day and swing traders, sometimes they ignore fundamental research about the company.

There could be a huge news item coming out that could rock the stock, and if you're just focused on the chart only you could miss it.

So if you are trading, thinking like an investor comes into play as well.

If you learn how to:

-Read charts

-Do fundamental research

You are setting yourself up for success no matter what type of trading or investing you get involved in.

That's exactly what we teach inside of Power Trades University.