I'm Here to Show You What's Possible

Back in September, in the midst of a global pandemic, I was able to make $94k in forty minutes trading options.

Now, I want to take you inside my trading account and show you exactly how I did it.

But before we get into all of that, I want to talk about something that makes me pretty sad. I recently had a Youtube comment asking if I could "show an example for regular people".

Here's the thing: I am a regular person.

I started out with just $500 in my trading account and nothing else but a dream.

I'm breaking down a big trade today where I had put in a lot of money to see that $94k profit but what I want you to really pay attention to is the rate of return....

I want you to see what's possible.

Want to participate in the comments? Click here to watch on YouTube.

And if you aren't subscribed to my channel for weekly videos - click here.

Pay Attention to the Percentage

To make $94k, I had to put a lot into this trade to make that kind of money but I don't want you to get discouraged.

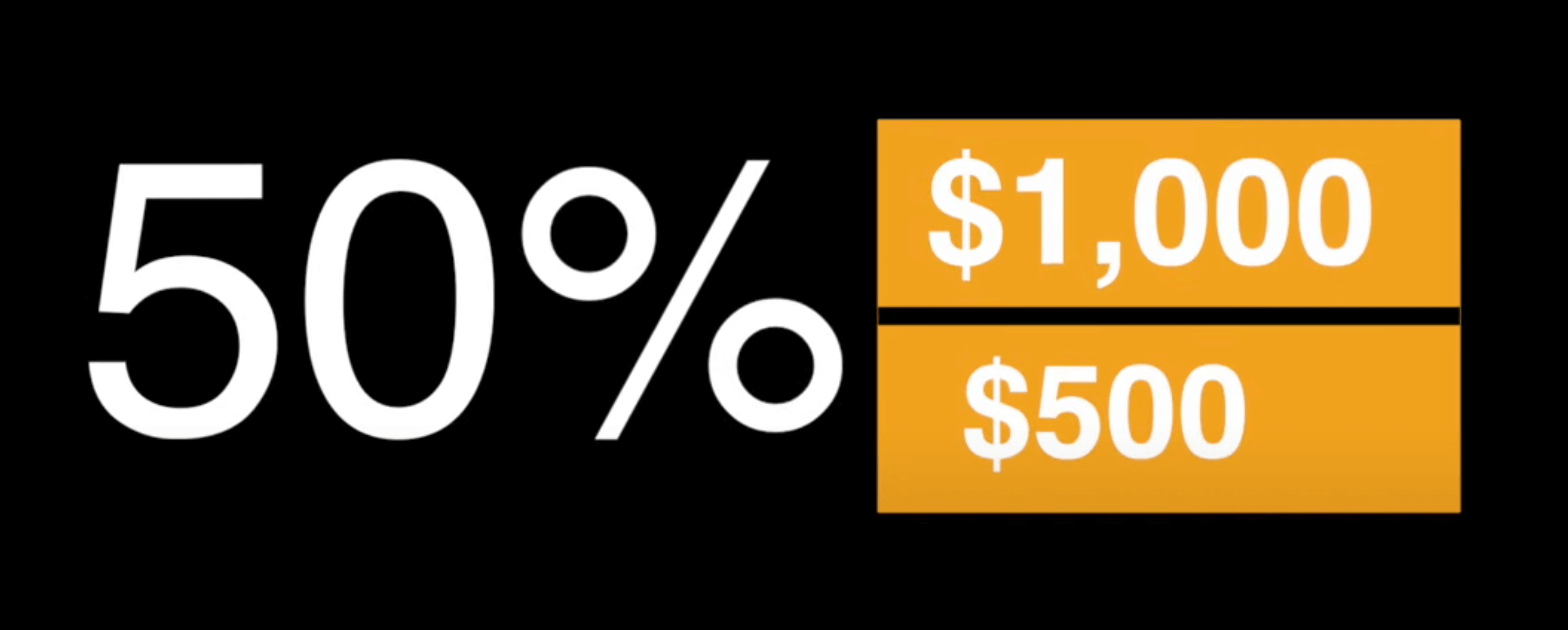

I want you to dream a little bit and I want you to really pay attention to the percentage.

I made a 50% return on this trade. That means that you could have done this exact same trade with $1,000 and walked away with a $500 profit.

Now here comes the dreaming part...what if you had $10k to invest? You could have made a $5k profit.

Do you see what I'm getting at?

Let's Take a Look at the Trade

Now, let's break this down.

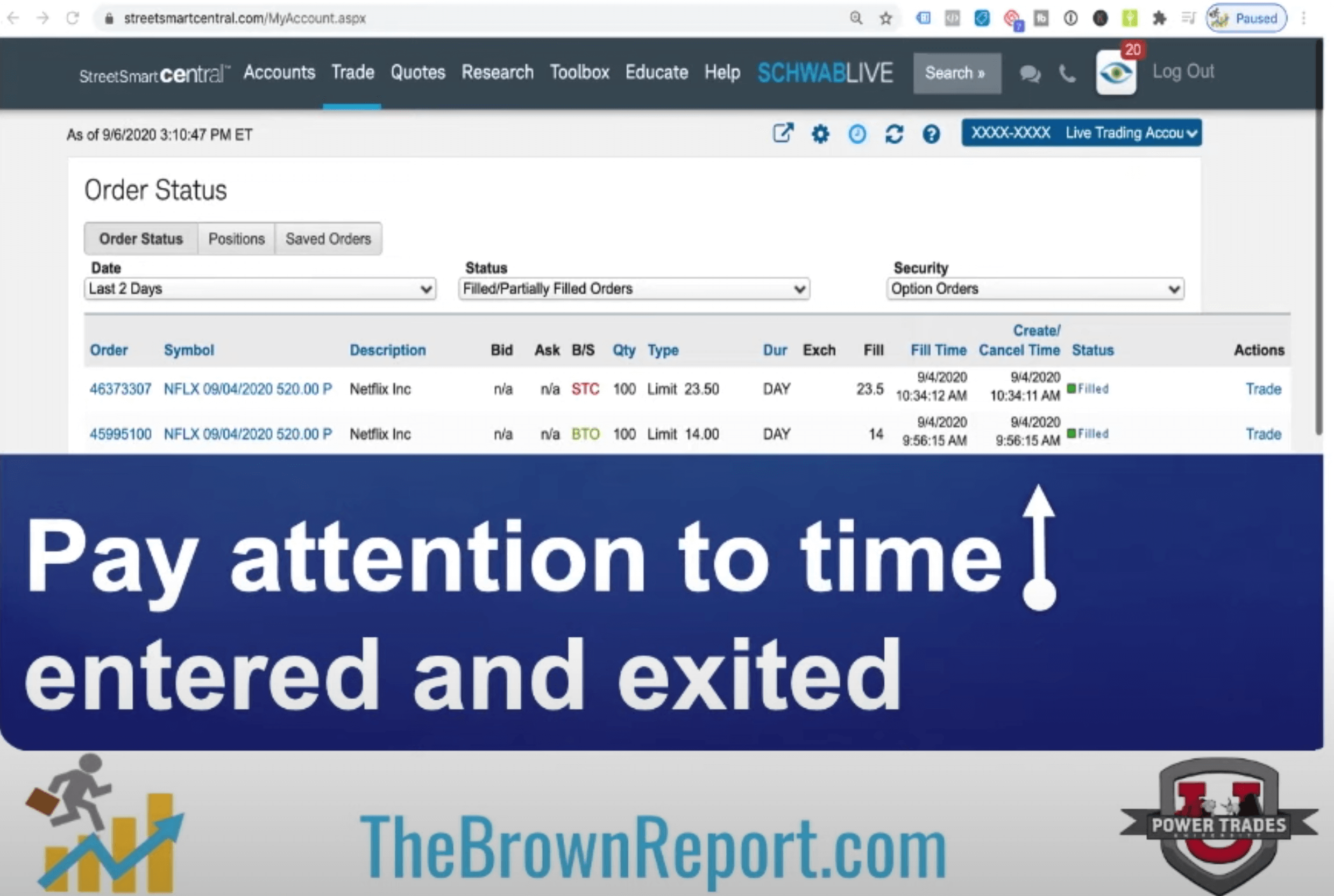

I bought to open (BTO) 100 contracts at $14. When we do the math, that's 100 contracts x $14 x $100 totaling $140k. That means I had about $140,000 in this trade.

Then I sold to close (STC) those 100 contracts at $23.50. Doing that same math from before, I sold 100 contracts x $23.50 x $100 which comes out to $235k.

To see the profit, I just subtract my initial investment of $140k from my total profit of $235k.

When you do the exact math on this trade, it comes out to $94,891.64

How I Saw This Trade

Now, I don't want to just give these numbers and call it a day. I want to show you exactly what I was seeing and what made me decide to enter into this trade.

I was watching this movement happening and that's when I saw it: a big, bearish candlestick.

I saw that around 9:40am and that's when I knew the market was selling off that day. It tried to bounce and couldn't, so that's when I entered the trade.

I saw that the market was weak and major selling was happening so I jumped in, grabbed some puts and then jumped right back out when I made a profit.

This is a lesson in not being greedy though, because as you can see on the chart, Netflix did rebound that day.

Anyone that held onto this trade would have given back the money and then potentially lost money because of how it continued to climb.

It's All About Strategy

I really want to drive this point home: if I only knew how to make money when the stock was going up, I would have completely missed this opportunity.

If all I knew how to do was buy low and sell high, I would have had no idea how to make the trade that brought in a 50% return.

Since I have the strategies to put me in a position where I don't have to run away because the market is "bad," I'm able to jump in and grab some put options to make money on the way down.

This is why understanding different strategies and knowing how to execute them is essential.

If you aren't sure where to get started, check out a few of my resources below:

1. Stock Market Starter Pack - Free Download - CLICK HERE

2. Stock Options Starter Pack - Free Download - CLICK HERE

2. What's the Best Trading Account for Me? - Blog Post - CLICK HERE