Navigating Stock Market Uncertainty: Strategies for Today’s Volatile Stock Market

Is the stock market crashing? Employment cost came out and increased by 1.2 percent causing bond yields to jump as investors fear the interest rates may be higher for longer. In fact, we may not get any rate cuts this year. Here, we're looking at what caused the sell off and how to play it going into the Fed speech and interest rate decision.

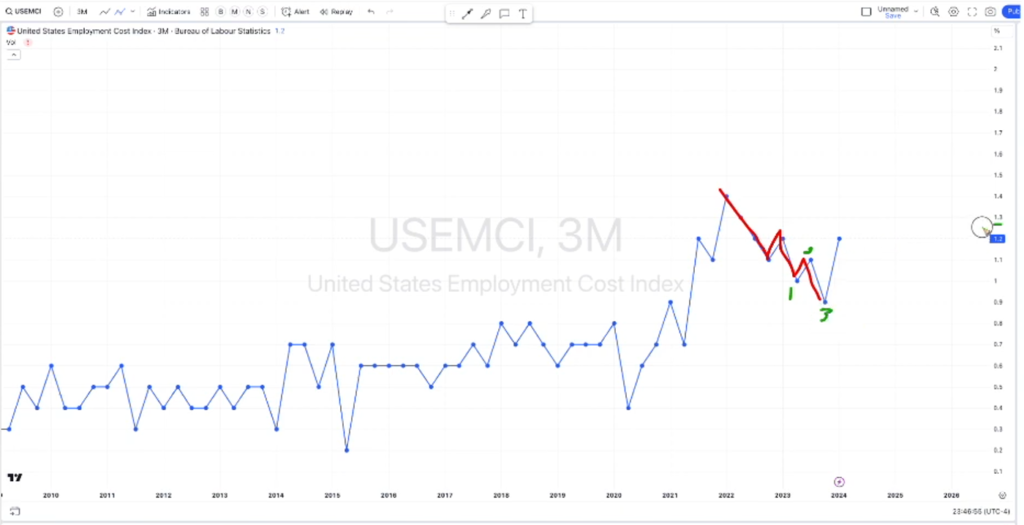

Understanding the Impact of Employment Cost Index

The employment cost index is a crucial economic indicator, especially in these times of inflationary pressure. A rise in employment costs signifies that companies are spending more on labor, possibly due to a competitive job market. This scenario can lead to increased consumer spending, which might keep inflation rates high—something the Federal Reserve has been actively trying to manage by manipulating interest rates.

With the recent data indicating a 1.2% increase, surpassing several quarters of decline, the markets reacted negatively because it suggests that the Fed might maintain higher interest rates longer than many investors had hoped. The initial market expectation of multiple rate cuts has been drastically reduced, now possibly down to zero for the year. This anticipation shift caused a significant sell-off, as you might have witnessed.

Stock Market Chart Analysis and Market Directions

The charts provide a narrative of caution in such unstable times. For instance, looking at the S&P 500, we've noticed declining volumes on up days, culminating in narrower market participation, which often precedes reversals or pullbacks. This pattern was evident in the lead-up to the sell-off, marked by a notable doji candlestick, indicating indecision but ultimately revealing the market's downward trajectory.

In addition, major companies like AMD, Amazon, and Tesla have shown disappointing post-earnings performance or failed to sustain gains, adding to the market's bearish sentiment. These individual stock movements contribute to the broader market outlook, signaling potential further declines.

Strategic Moves for Protecting Your Portfolio

In light of this new information and market sentiment, here are a couple of strategies you could consider:

1. **Put Options:** Given the bearish signals and overall market uncertainty, buying put options can be a prudent way to hedge your portfolio. These options increase in value as stock prices decline, providing a buffer against potential losses.

2. **Capital Preservation:** In turmoil, preserving capital should be a priority. This might not be the season for aggressive acquisitions but rather for reassessing your portfolio's risk and exposure.

3. **Stay Informed:** As always, staying updated with the latest market data and economic indicators can significantly influence your trading decisions. Keep an eye on upcoming Federal Reserve announcements and other pertinent financial news.

Watch the Full Scoop and Stock Market Analysis

Whether you're looking to actively manage your portfolio or simply stay informed, this market update is packed with valuable advice on navigating a volatile market. Watch the full video below:

Time Stamps:

[00:00:00] - The market's sell-off and plans to delve into the data, charts, and strategies for protecting accounts or making money.

[00:01:17] - Newly released employment cost data which spiked unexpectedly.

[00:02:51] - Significance of the recent rise in employment costs and its potential impact on upcoming Federal Reserve decisions.

[00:04:40] - Specific stock movements, including Advanced Micro Devices (AMD) and Amazon, and their implications for the market.

[00:07:22] - Predicts further market drops and suggests protective strategies such as put options, especially in light of the Federal Reserve possibly maintaining higher interest rates for longer.