The Magnificent 7 Stocks: A Closer Look at NVIDIA, Tesla, Microsoft, Apple, Alphabet, Amazon, and Meta

In this video we're looking at the Magnificent 7 stocks. Microsoft, Meta, Apple, Tesla, Nvidia, Google and Amazon. All have big earnings reports coming out which could be make or break for the stocks. I'm walking you through who has held up the best during the recent pull back and what to expect during earnings.

NVIDIA: A Semiconductor Leader Showing Warning Signs

NVIDIA, a dominant force in the semiconductor industry, has recently shown troubling signs that demand attention. Traditionally a robust performer, the stock has unexpectedly broken below its 10, 20, and 50-day moving averages—a clear signal of a potential trend reversal. This deviation from the norm could imply broader sectoral shifts or even cooling off of the ongoing AI hype. Investors should keep a close eye here, as NVIDIA’s movements could herald significant changes for the semiconductor sector at large.

Magnificent 7 Tesla: Volatility Post-Earnings

Tesla continues to be a focal point of market dynamics, demonstrating substantial price swings and testing critical support levels. After dipping below the $160 mark to $140, a recovery was seen pre-market post-earnings announcement. However, the earnings details themselves were mixed, with missed delivery targets overshadowing any positive news. The higher interest rates environment adds another layer of complexity, potentially discouraging consumer spending on big-ticket items like cars. Caution is advised as Tesla could still experience more turbulence.

Microsoft: A Cautious Approach Before Earnings

Microsoft has shown resilience by pulling back to a solid support level without breaking down like some of its peers. However, with earnings on the horizon, a cautious approach is warranted. Investors should remember the Netflix scenario—where good earnings were overshadowed by poor forward-looking guidance, leading to a sharp sell-off. Until Microsoft’s financial health and future outlook are clearer post-earnings, holding off on aggressive moves might be wise.

Apple: Positioned for a Potential Upswing

Despite being in a downtrend, Apple has maintained a reliable support level and is currently forming a wedge pattern which could soon resolve upward. Excitement is also building around a possible announcement at an upcoming special event, speculated to introduce enhancements to the Mac lineup. With much of the negative news likely priced in, this could be a strategic entry point for investors anticipating a rebound.

Alphabet (Google): Steady as She Goes

Alphabet, unlike other tech giants, has not suffered significant losses during recent pullbacks, instead showing minor dips and quick recoveries. Its resilience suggests underlying strength, but with earnings approaching and prices nearing the upper channel, a strategic wait-and-see approach might be best. Pullbacks post-earnings could offer more attractive entry points.

Amazon: Uptrend Intact Despite Pullback

Amazon has experienced a notable pullback but within the context of its long-term uptrend. This relative stability, compared to the sharp declines seen in companies like Tesla, positions Amazon in what I call the "winner's circle." Investors might find reassurance in Amazon’s enduring growth narrative and consider using any further dips as buying opportunities.

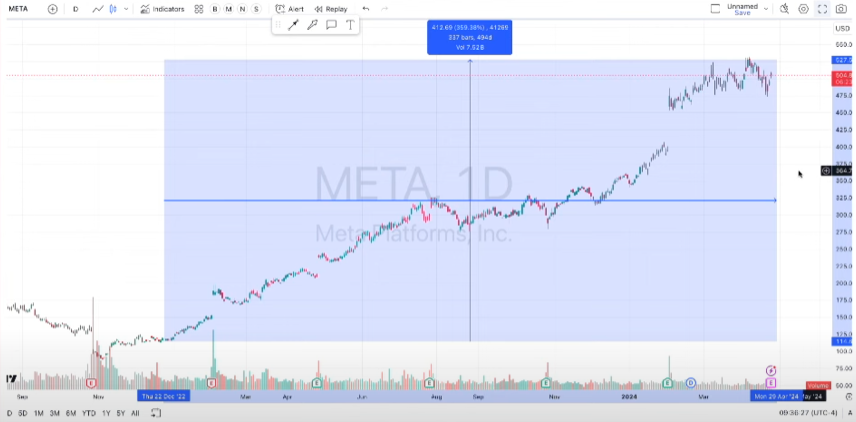

Top Magnificent 7 Contender - Meta (Facebook): Watch for Earnings Impact

Meta has enjoyed a significant upward trajectory, registering impressive gains. However, recent patterns hint at potential topping, suggesting that the upcoming earnings could be pivotal. A positive surprise could sustain or even boost the current trajectory, but disappointing results might mirror NVIDIA’s downturn.

Magnificent 7: A Cautious Outlook as Earnings Season Heats Up

Market reactions to these earnings will be telling: strong results and positive guidance could reaffirm confidence, while any disappointments might magnify selling pressures. For investors, staying informed and responsive to these developments is key. Watch the full analysis below:

Time Stamps:

[00:00:00] Tech stock sell-off prompts semiconductor sector scrutiny. Tesla at 160 level pre-earnings.

[00:04:42] Cautious about investing in Microsoft ahead of earnings.

[00:07:42] Google outperformed during pullback, earnings ahead.

[00:11:27] Cautious approach to stock earnings, potential purchasing opportunity.