Palantir Technologies (PLTR) Stock Analysis: Is It Time to Buy or Wait?

PLTR Stock, also known as Palantir, has been one of the most searched stocks on the internet. The question on everyone's mind is: "is it time to buy or sell?" I'm diving into the fundamentals of the company as well as looking at the technical chart to give you the most comprehensive view of what to do.

The Core of Palantir's Operations

Palantir, co-founded by notable names such as Peter Thiel and Stephen Cohen, develops software platforms that enable businesses to integrate, manage, secure, and analyze large datasets efficiently. Serving a customer base that spans government agencies, financial institutions, and commercial enterprises, Palantir operates on a subscription-based revenue model. Its suite of platforms, including Foundry, Gotham, Apollo, and AI and operations capabilities, provides a comprehensive system for global decision-making and data analysis.

Palantir Revenue and Growth Prospects

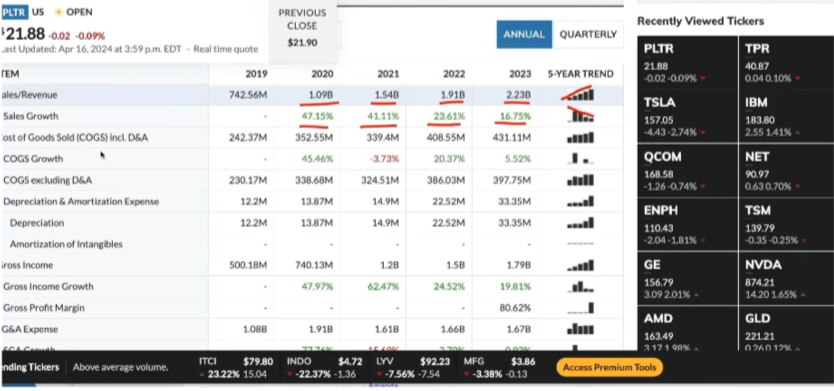

On the surface, Palantir's revenue growth appears strong with the numbers showing an upward trajectory year after year. However, a closer look reveals a concerning trend of declining growth rates, dropping from 47% in 2020 to an estimated 16% in 2023. Moreover, the cost of goods sold, encompassing the deployment of AI infrastructure, is on the rise. This combination of slowing growth and increasing costs poses potential issues for Palantir as an attractive growth investment.

Interpreting Palantir Chart Patterns

An analysis of PLTR's stock chart illustrates both promise and caution. In the short-term perspective, the stock has shown resilience by bouncing off low levels around $8–$10 to double in value. From a technical standpoint, the current pullback to support could represent a buying opportunity. However, long-term analysis paints a more sobering picture — the stock remains significantly below its all-time highs, and resistance near the $27 mark could cap potential returns.

Palantir Relative Position in the Market

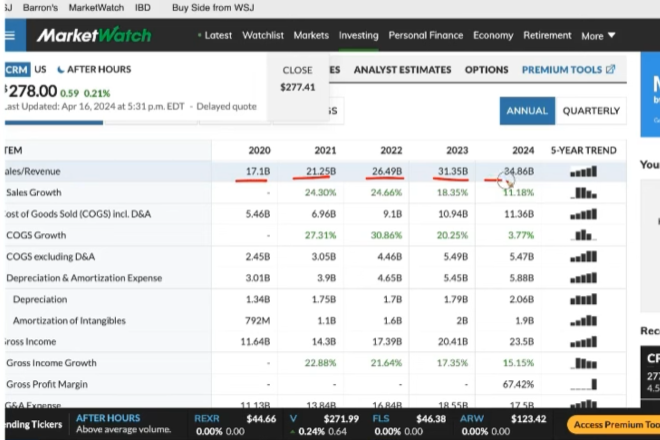

Palantir is not alone in the data analytics space, and its valuation must be considered in the context of its competition. When placed beside Salesforce (CRM), a more seasoned player with positive net income over several years and a less demanding PE ratio, Palantir's stock appears less compelling. This comparison raises questions about Palantir's capacity to outperform and gain further market share in the rapidly expanding AI and cloud computing sectors.

To Buy or Not to Buy?

The impending earnings report could be a make-or-break moment for PLTR. The trends hinting at an increase in costs and declining sales growth put a question mark over the company’s future performance. Until more concrete data is revealed that assures investors of Palantir's direction, the sideline may be the best seat for the moment.

Tune in to find out what I'm doing with PLTR and get the full breakdown:

Time Stamps:

[00:00:00] PLTR, Planter: software company with stock analysis.

[00:05:15] Company's stock rebounded but still below peak.

[00:06:16] Company's lack of profitability; high PE ratio.

[00:11:23] Long term resistance, cautious about stock purchase.

[00:13:31] "I'll see you on the next video."