The Impact of Chipotle's 50-for-1 Stock Split: What It Means for Investors

Chipotle just announced a 50 for 1 stock split. It still has to be voted on by the current share holds, but if the split happens, this could mean big opportunity for regular people. In this article I break down why you should care. I also compare other companies who have had similar stocks splits and what happened to them after the split.

Decoding Chipotle's 50-for-1 Stock Split:

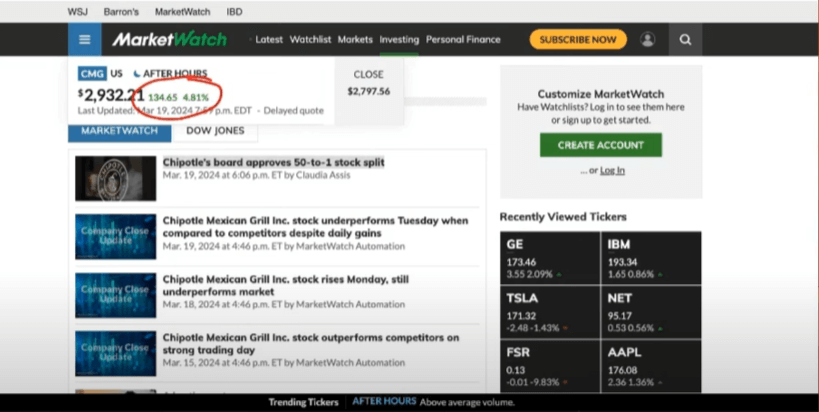

Chipotle's decision to initiate a 50-for-1 stock split is a strategic move aimed at making its shares more accessible to a wider range of investors. The stock's surge of 4.8% after the announcement signifies the market's positive response to this decision. Shareholder approval, scheduled for June 6, 2024, is the next milestone. If passed, each current shareholder will receive 50 shares for every one they own at a new price of approximately $60 per share, compared to the current price of $2,932.61.

The Impact on Stock Price and Market Dynamics:

After-hours trading showed a $134.65 increase in Chipotle's stock price. This signals a boost and is due to the potential for lower prices after the split. This reduction in the individual share price could attract new investors, driving the stock's value even higher. The analysis also indicates that Chipotle's stock has soared by 27% in just three months, showcasing its impressive performance.

Lessons from Other Successful Stock Splits:

To truly appreciate the potential impact of Chipotle's stock split, it's important to examine similar events in the context of other companies. Amazon's 20-for-1 stock split led to a significant decrease in its share price, making it more accessible to smaller investors. This led the stock to nearly double in price after the split. The pattern is repeated with Google, which, after its 20-for-1 stock split, saw substantial growth in stock value. Walmart's 3-for-1 split also resulted in sustained stock price appreciation after an initial dip.

Opportunities for Investors and the Future of Chipotle:

The stock split presents an enticing opportunity for investors. It also potentially opens the door for more widespread ownership of Chipotle shares. By making the stock more affordable, the company aims to encourage investment not only from traditional stockholders but from its own employees. As history has shown with other successful stock splits, this move may signal the beginning of continued upward momentum for Chipotle's stock.

The Chipotle stock split presents a compelling opportunity to observe firsthand how such strategic moves can shape the trajectory of a company's stock. Keep an eye on how this development unfolds and consider the potential impact it may have on your investment portfolio.

Catch the full break down here:

Time stamps:

[00:00:00] Introduction to Chipotle's 50 for 1 stock split and its impact on stock price.

[00:00:38] After-hours surge in stock price and details about the stock split including the new low price and shareholder approval.

[00:01:59] Reasons behind the stock split, including making the stock more affordable for employees and the potential impact on new investments.

[00:02:52] Analysis of the stock's performance over time, including the rise in stock price and record returns.

[00:06:20] Closing thoughts on the significance of the stock split and whether viewers are considering investing in Chipotle stock.