A Closer Look at Truth Social's Valuation and Stock Performance

We're pulling back the curtains on Truth Social Stock, ticker symbol DJT. This is Donald Trumps Truth social media company that recently went public. The stock has had some exciting initial trading days but where does it go from here? Let's unpack the stock, the valuation, and where it might be headed next.

Exploring Truth Social's Valuation:

Let's dive straight into the heart of the matter - the valuation of Truth Social. Donald Trump's social media venture, which went public via a SPAC, operates under the ticker symbol DJT. Upon its initial public offering, the company boasted a user base ranging from 2 to 3 million users. What's remarkable here is the staggering valuation it achieved, reaching an intraday high of approximately $10 billion. To put this into perspective, with Trump owning a substantial 58% of the company, he stood to make a massive potential windfall of $5.8 billion due to the soaring stock price on its trading day.

Comparative Analysis:

Now, let's compare this to other well-established social media companies. For instance, when Facebook went public in 2012, it had a user base exceeding 900 million and a valuation of $104 billion. Similarly, in 2019, Pinterest, with around 291 million monthly users, achieved a $10 billion valuation upon going public. Contrasting these figures, it's evident that the valuation of Truth Social appears disproportionately high considering its relatively modest user base. This raises the question of whether the market sentiment accurately reflects the company's true worth.

Stock Performance and Downward Trend:

The appeal of the initial valuation did not hold up over time. The stock took a downward slide shortly after its public debut. This prompted concerns about the sustainability of its valuation. The downward trend continued, leading to consecutive days of decline in the stock's price. This persistent slide emphasizes the uncertainty surrounding the company's market standing and investor confidence. The declining volume further indicates waning interest in the stock. This suggests that selling pressure may be starting to ease but not without potential for further decline.

Implications and Speculations:

As we unravel the complex dynamics of Truth Social's stock price, compelling speculations surface. One noteworthy aspect to consider is the potential motivations behind the extraordinary valuation and subsequent stock performance. It raises the question of whether this strategy could serve as a unique method to circumvent campaign finance laws. Could this be a meticulously orchestrated means for Donald Trump to raise significant capital without the need for full disclosure of investors? These speculations add layers of intrigue to the unfolding narrative of Truth Social's market journey.

Options Market Insights:

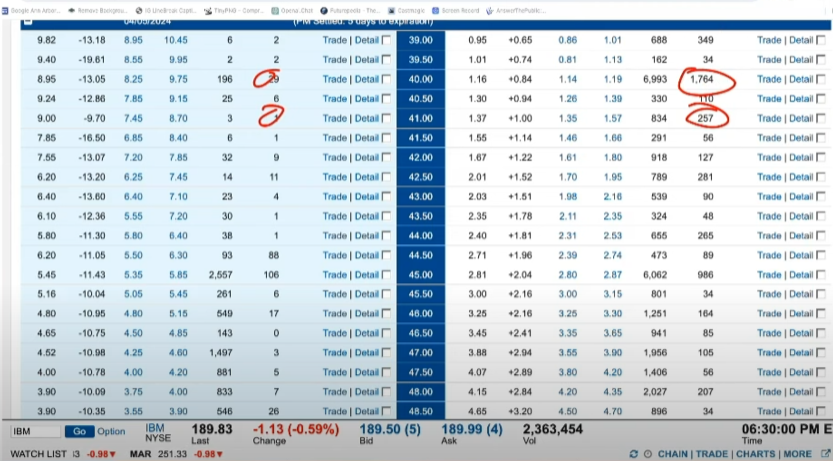

Venturing into the options market provides insightful indicators about investor sentiment. Notably, the divergence between the call and put options reveals a significant preference for put options, signaling a bearish outlook. Additionally, the substantial volume of put options at lower strike prices alongside the declining stock price projects an anticipation of further downside movement. With the valuation concerns and the downward trend of Truth Social's stock, will traders be inclined to invest in DJT?

Lets fully unpack it here:

Time stamps:

[00:00:00] - Introduction to Truth Social and its valuation compared to other social media companies.

[00:00:33] - Initial valuation and Donald Trump's potential earnings from the company.

[00:01:30] - Comparison of Truth Social's valuation to other social media companies and its impact on stock performance.

[00:02:35] - Analysis of the stock's performance, volume trends, and potential future stock prices.

[00:03:53] - Examination of call and put options trading, analysis of put options volume, and speculation on potential stock price movements based on options trading activity.