If you have been following the previous weeks, we have now broken down what stock options are in general and what call options are.

Now we are moving into my favorite subject – put options.

Why are put options my favorite thing to talk about?

Because I love proving to people that you can actually MAKE money from the stock market falling.

How? Let’s get into it.

Want to participate in the comments? Click here to watch on YouTube. Be sure to hit “subscribe” for our weekly videos.

Podcast Version:

Now on SPOTIFY You can also listen on iTunes and Stitcher

As a brief review to freshen up your memory…

An option contract is a contract for the right to buy a specific asset at a specific price for a specific amount of time. And that option contract has a small fee.

What is a Put Option?

A put option is a contract that allows you to force someone to buy your stock from you at a certain price for a certain amount of time.

Why would you want to do that?

For insurance.

In fact, I like to call put options, “insurance options”.

Let’s break this down is an example

Because you are already IN A PUT OPTION CONTRACT and you probably don’t even know it….

No matter where you live, you are mandated to put insurance on your car, right? You pay a premium every month to an insurance company. This is for in the event that you get into an accident, the insurance company would insure or repair the car.

If you have a $50,000 Mercedes Benz, you would probably pay something like $200 in insurance a month for full coverage in case anything happens to it.

Earlier today, you went out to run some errands. Unfortunately, someone runs into your car and you got into an accident.

The car shop renders your car totaled.

If you did not have insurance, you would be at a total loss.

But because you pay $200 a month for insurance, you can now exercise your option and now force the insurance company to purchase your worthless Mercedes Benz.

But because you pay $200 a month for insurance, you can now exercise your option and now force the insurance company to purchase your worthless Mercedes Benz.

An option is the right to buy/sell a specific asset within a specific amount of time. So we have all of the components:

Asset – Mercedes Benz car

Amount of time – 30 days (monthly fee)

Cost of asset – $50K (or whatever it is worth at the time of accident)

Cost of the contract – $200 per 30 days

The buyer – the insurance company

Why is this “put option” beneficial?

For you…

Take the fact that car insurance is required by law out of it… It’s beneficial for you because you have an asset that costs you a lot of money and you want to protect the asset should something bad happen.

For the insurance company…

Why would the insurance company be willing to take on this risk?

They have done their research on you – where you live, where you drive, the same demographic as you, etc… and they believe that they can make the $200/month.

They are willing to sell the option because they have done their homework and do not believe you will total the car.

So there are two different thoughts here.

You are thinking – just in case something happens because it might, let me get this insurance.

The insurance company is thinking – you don’t seem to have a bad history from our background check, this isn’t a high risk and we get $200 a month.

If the insurance company has 500 people every single month giving them $200 (that’s $100K a month)… it will not destroy them if now they need to pay for your car when it has been totaled.

The stock market works the same way.

In the stock market, there are put option strategies where the process makes sense for both the buyer and the seller, just like in the example with the car insurance.

There are opportunities for you to be the buyer of put options, and also act as the “insurance company” and actually collect premiums as the seller of put options.

It isn’t gambling.

You are figuring out on probability and statistics if each put option would be the right “insurance policy” for you, and on the other side the “insurance company” (the seller) is doing their homework and making sure that this put option makes sense, too.

How Put Options Work in the Stock Market

WHEN THE STOCK MARKET IS GOING UP

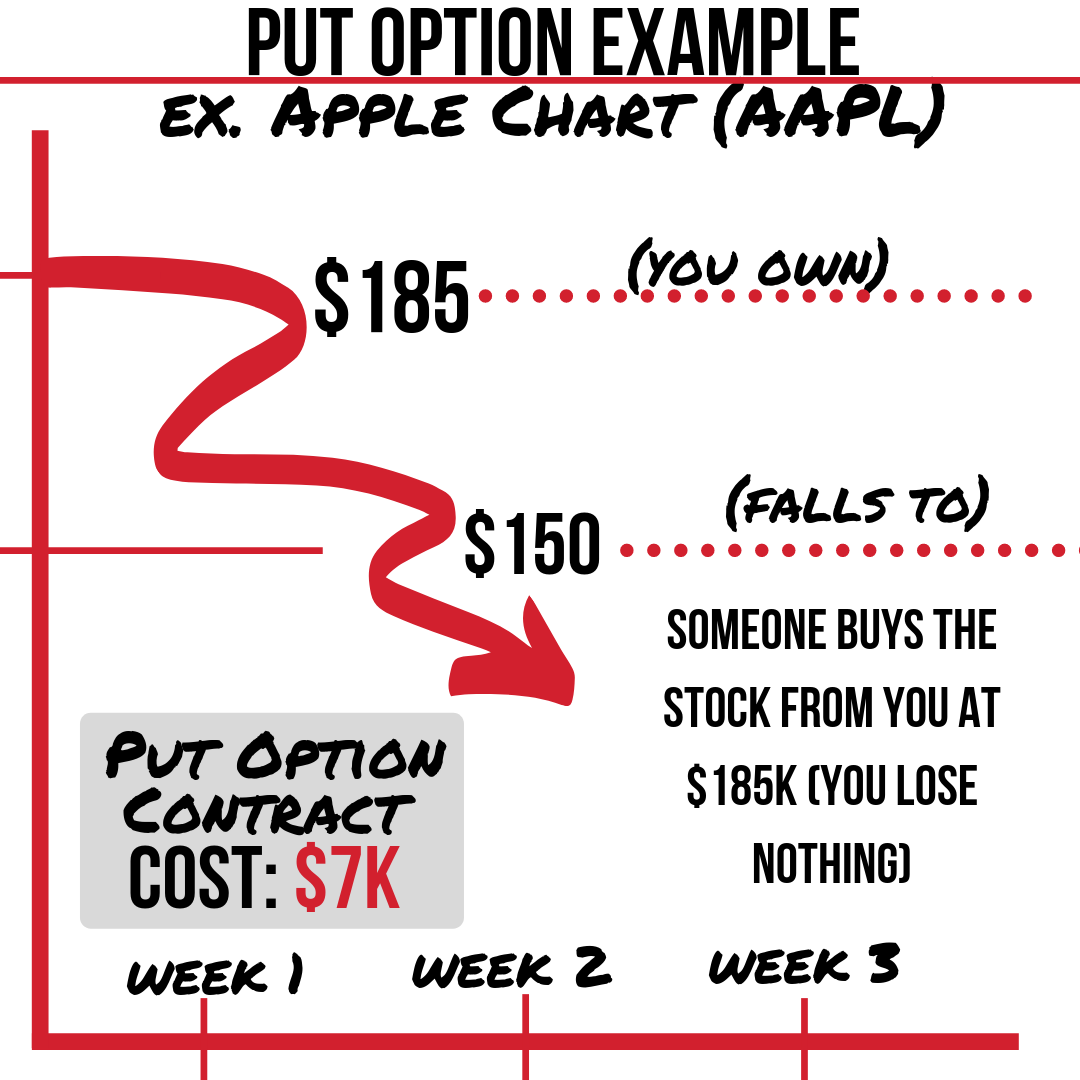

Let’s say 1 year ago you bought 1,000 shares of Apple (AAPL) when it was trading at $100/share. That would have cost you $100,000.

I am looking at the stock today on the week of June 3rd and it is now trading for about $185.

You are now profitable $85,000.

(If you are thinking… these numbers are too big for my account… I want you to still stick with me. Because you may still have an IRA or retirement account. Substitute that money with the money we are using for the example tied up in Apple stock.)

If you are researching the stock market and feel like you need to protect your assets in Apple, you could lock in the $185 price for a certain amount of time with a put option.

I am looking at the potential put options, and you could purchase a put option contract that expires in 44 days for $7/contract (which controls 100 shares).

You would by 10 put options at $7 x 10 contracts x 100 shares = $7,000.

You have $185,000 tied up!

If based on the chart and probability and statistics, you think the Apple stock will eventually go up to $200K – you definitely wouldn’t want to just sell it.

BUT to protect yourself and reduce your RISK for the near future –

Wouldn’t it make sense to spend $7K to protect your $185K?

It may not be probable but it is possible that the stock could go back down. You would be devastated if you gave up money when you could have protected.

You would then be willing to put up $7K as insurance! To lock in that $85K profit you have already accrued.

What happens if the stock doesn’t dip – but in fact goes up to $200?

What happens to the $7K put option contract you purchased?

Well if the expiration date has come and gone – the money is gone.

Just like your car insurance premium. The insurance company still keeps the money even if you didn’t crash.

But just like that car insurance – you had peace of mind that your profit was locked in should anything bad happen to the stock market until the expiration of the put option.

Then you can decide if you want to purchase insurance again.

I cringe when I think about…

…all of the people who have told me in the past that they LOST their retirement account and didn’t have insurance on it, so they had to go back to work.

And these are people paying financial advisors! Their financial manager did NOT sit them down to talk about put options or how to save that money!

If you are telling me I could have spent $7K to protect my retirement account to being cut in half when we are in uncertain times – wouldn’t I do it??

You wouldn’t do this every single month…

But there are times when things turn and we live in uncertain economic times when you are able to protect your account.

WHEN THE STOCK MARKET IS GOING DOWN

Now let’s think about the same situation – but at a different angle.

When you owned Apple stock and decided to buy a put option on it – someone on the other side of the computer decided to take on the risk and give you that insurance policy and collect the “premium” of $7K.

For the next 44 days – they do NOT believe the stock is going to fall.

That’s what creates the market.

Two people looking at the same chart – but coming to two different conclusions.

This is what makes the market move – obviously technicals, practicals and fundamentals do… but TWO different people are interpreting it differently.

So what happens if Apple stock does fall all the way down to $150 within those 44 days?

The way the put option work is just like how your insurance works…

If the stock falls and you have purchased $7K (in this example, prices obviously vary) for a put option in Apple stock, you can now login to your account and exercise your option contract!

The other person who took the risk of granting you the “insurance” now has to buy the stock from you at $185K even though technically it is now only worth $150K.

The other person who took the risk of granting you the “insurance” now has to buy the stock from you at $185K even though technically it is now only worth $150K.

That person does NOT get to say “it’s worth less” – no. That was the risk they assumed hoping it wouldn’t happen… but it did.

You have a contract that says he HAS to buy it from you at that price.

That is how you get your account restored.

You would have lost that $35K, but because you bought insurance – you now have that money restored back to $185K.

When you think about it…

…You spend insurance money every month to protect your car, your health, your house.

THIS is the same strategy – to protect your retirement or investing account.

What you need is the education, the ability to read stock charts, and the strategies in place to protect yourself in the stock market by using option trading.

How to Use Put Options Without Owning the Stock

You can also use put options even if you don’t actually own the stock, unlike our example above.

Let’s say instead you just bought the $7 put option contract on Apple for the next 44 days at the 185 price.

What if the President tweets about tariffs and Apple stock DROPS $35?

Because you had that contract, you can now force someone to buy the stock at $185 – even though it is now at $150.

That piece of paper is now worth $35, even though you only paid $7 (per contract) for it.

You can also sell that piece of paper to someone else who wants the stock to force someone to buy it. This is the “flipper” (see previous post) – they just want to take advantage of the price movement. They flip the contract to someone else, without actually owning the stock.

Most people only know how to make money from the stock market moving UP.

Well, today, you learned that you can also make money AND protect your account – even if the market does DOWN.

When you learn these strategies, you will feel more confident in putting your money to work because you have what it takes to make money no matter what the market throws at you.

If you would like to learn more about option trading, click here to register for my free Option Trading webinar…

…and of course we offer premium courses AND weekly live Group Coaching sessions where we walk through with our members strategies in the current market – such as the specifics of the ones mentioned above. You can check all that out by clicking here.