In this series, so far we have introduced stock options, explained more specifically how call options work and how put options work… and now we are going to dive in deeper.

What are ADVANCED options and how do you use them to become a financial architect?

Once I started to learn how spreads (advanced options) worked, it really expanded my horizons as far as money making and limiting risk.

Want to participate in the comments? Click here to watch on YouTube.

And if you aren’t subscribed to my channel for weekly videos – click here.

You can also listen on Spotify, iTunes and Stitcher

Spreads are the use of two or more options.

Before, we talked about when the right time to buy a call option is OR the right time to buy a put option.

But with spreads… there can actually be a right time to buy both.

When most people think about investing, most only think about buying a stock. The next level of that would be learning to trade stock options.

THEN you work your way through that level…. and now it’s time for spreads.

(If you don’t yet have knowledge about the first two levels of trading stocks or option trading, you must get more education before moving on to actually trading or considering advanced options, like inside my program with Power Trades University)

Why are spreads beneficial?

The short answer is: they can limit risk and in some cases create a neutral trading strategy where it doesn’t matter if the stock goes up or down. You can make money either way: whether it goes up or down.

You can construct a higher profit variable AND in some cases, your goal is to break even and to come out unscathed when you realize your initial trade was going wrong.

The stock market can only move 3 ways: up, down, or sideways.

If you only know how to trade one way, then you only have a 33.3% chance of being right.

But what if you had the knowledge to make money 100% of the time?

(Not guaranteed that you will make money 100% of the time, but having the knowledge of how to do so)

This is what option trading and spreads allow you to do – have that knowledge.

Here is an example to relate to real life…

Let’s say you are browsing your Instagram or Facebook and you see an ad for a cool product that you would like to buy for $50 and you think that is a good price.

So you click on over to the site and it says you are going to purchase from Amazon. BUT it may not ACTUALLY be the Amazon website, it could be a fulfiller seller (FBA). This means there are a lot of small independent entrepreneurs in which you can create your own online store, and have the purchases of your product be fulfilled by Amazon.

For the sake of the example, let’s call this entrepreneur shop “Little Shop”. You place the order to purchase and you are going to get it in 7 days.

You purchased something for $50 from the Little Shop VIA Amazon.

Now the Little Shop has $50 and goes to important the item. They go to the supplier and purchase item for $25, then it costs $5 to ship it to the Little Shop location, then $5 to ship it to you as the buyer.

The Little Shop paid $35 but just made $15 on the spread.

They didn’t own the product BUT has a relationship with the seller (amazon) and the producer company.

Everyone says “it takes money to make money”

But this is an example where someone didn’t need money to make money. They needed an idea and a relationship, and a website with Amazon.

Everyone is happy:

You as the buyer gets the product they wanted. The Little Shop made $15 with little work. The producer/supplier got to make the product. And Amazon gets a cut of each sell.

What does this have to do with spreads?

Everything.

This is how it works in real life…

But let’s look at the stock market.

You are the buyer of stocks as a trader. Your broker is like Amazon, you have to use TD Ameritrade or Charles Schwab or another account in order to actually buy anything. They are the bringing the buyers and the sellers TOGETHER.

In call options, you can buy an option for $10 with the agreement that you will sell something for $100, and if that stock moves up to $120, that option contract is now worth $20. You are not actually buying the stock, the “inventory” in this example. You can now sell the contract for $20 and make an easy $10.

What makes it a spread?

Let’s continue the same example.

A Real Spread Example (Bull Call Spread)

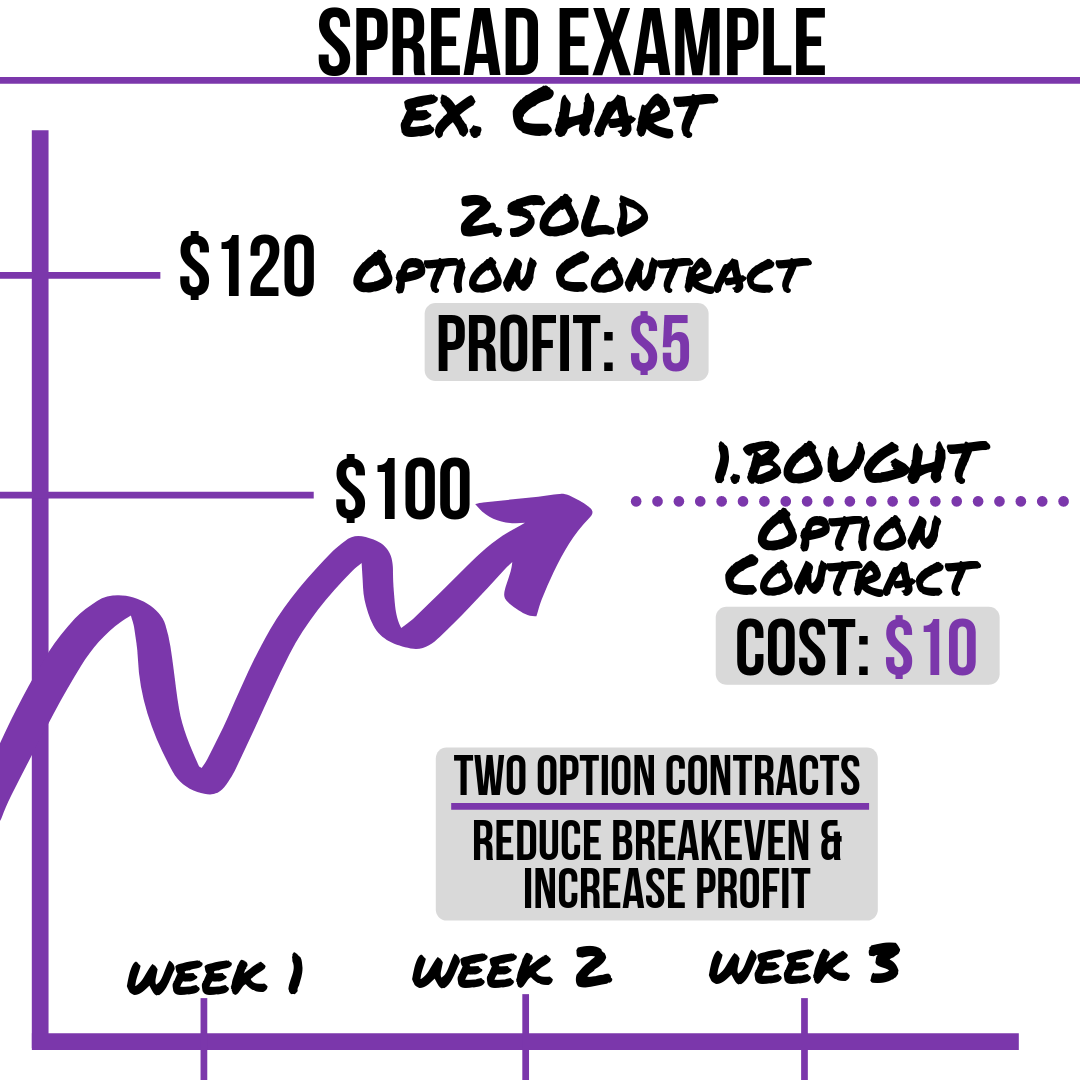

You purchased $10 contract on a stock that is worth $100. You are hoping it goes up to $120.

This is where a spread comes in.

If it does what you thought it would do and goes up to $120, you can exercise the right of your option contract and purchase the actual stock for the initial cost of $100.

BUT again this is your hope. What if you are wrong?

You can now sell someone the $120 option.

If there are buyers at $120 option, they are willing to buy it for $5.

You bought the $100 option and paid $10 for it, and the contract is valid for 30 days. Where does the stock need to be at at the end of the 30 days for you to break even?

It needs to be at $110.

You have analyzed the chart and have determined it can get to $120.

But again, there are other traders who have looked at this same chart and are willing to buy the $120 option for $5.

Here is what you can do:

You paid $10 to buy the $110 contract, then you SELL the $120 option contract for $5.

What just happened?

The first portion is that you can buy the stock for $100, and someone else can buy it from you at $120, if it should go there or higher.

The first portion is that you can buy the stock for $100, and someone else can buy it from you at $120, if it should go there or higher.

That is a $20 spread.

The cost:

You paid $10 BUT you sold someone a contract to buy it at $120 for $5. Now you only spent $5.

Because you now only have $5 at risk…

What happened to your breakeven?

Before you needed it to go to $110 to break even.

NOW you only need it to go to $105!

You used a combination of options to LIMIT your risk.

If the stock goes to $120, the difference is still $20. Now you can make $15 because you already lowered your risk by $5.

WAIT A MINUTE. Let that sink in.

By using two options, you just:

1. Lowered your risk

2. Increased your profit

You are capped at what you make at $120 because of your contract – you do not care if the stock goes higher than that.

The person who bought it at $120 needs it to go to $125 to break even, since they purchased the contract from you for $5. But if it goes to $120 – BOOM you made your profit.

That is just one example – of a Bull Call Spread.

But there are oh SO many more… Bear Put Spread, Bear Call Spread, the list goes on… and there is no way we could talk about them all here in this one blog post. It is so much better done in a visual illustration or videos.

We CAN dive deep into them and analyze each one in… let’s say a course with videos and community… although we already have that! Check it out here in our Power Trades University community forum, as a part of our All Access membership.

“Financial Architect”

I want you to think about that term.

And even begin to start thinking about how you could become one.

An “architect” is someone who can design and construct a building and bring a VISION to life.

A “financial architect” can design trades and investments to bring PROFIT to life.

You look a trades with clarity – if the trade goes sideways, you’ll do this. If it goes up, you’ll do this. You minimize your risk this way and maximize profit that way.

You are READY for whatever the stock market through at you.

NO ONE can guarantee you making profit 100% of the time and never losing any money.

But what you can be guaranteed is…

If you become a financial architect and learn options and spreads, that is going to be your best chance at limiting your risk that comes along with investing and trading in the stock market.

What would happen if you mix calls and puts together?

In the Bull Call Spread example above, we bought two call options.

What happens if you buy a CALL and a PUT together?

There are advanced strategies (like the Strangle) where you buy an out of the money call option and out of the money put option and NOW it doesn’t matter which way the stock moves – it just needs to move big in one direction.

You don’t need to be right about it.

It just needs to move big – either up or down.

There is another advanced option called a Straddle where you buy a call and a put option at the SAME strike price. $100 call, and $100 put.

Again – it doesn’t matter if it goes up or down but now the question becomes: How much does it need to go up or down for it to swallow up the cost of both option contracts?

There is COOL stuff out there when you become a financial architect.

A Tip:

With your brokerage account, there are certain levels of approval when it comes to trading options.

Advanced options I believe is a level 4 in most cases. So before you become approved to trade advanced options, you really need to know your stuff.

Brokerage companies are NOT giving these approvals away – because you are now talking about two options and now even talking about mixing and matching them.

Brokers are saying these a great concepts, BUT most people don’t understand math or how it works. So they make you prove it with a small test and analyzing how much is in your account.

Sometimes they even want to talk to you on the phone to make sure that you understand HOW it works – because you can’t be making bug mistakes all the time.

The brokers will have zero sympathy if things go wrong because you told them that you knew how to trade options, and they don’t want to get blamed for something you said you could handle.

If you are needing to get more education, of course you can do so with our Advanced Options course inside of the All Access membership of Power Trades University. We even have a quiz at the end to make sure you know your stuff.

That doesn’t provide a guarantee that they will approve you, but definitely helps in your understanding of it.

The big picture is…

I want you to understand that these strategies are HERE and they can reduce your risk and increase your profit.

The knowledge is POWER and it is key!

If you have ever said, “I want to get started in the stock market, but I am scared” or “I’m nervous” or “What if I lose my money?”

I can’t guarantee you that you won’t lose all of your money BUT I can guarantee that if you learn all of these strategies, it removes a lot of the fear.

You can’t totally eliminate risk, but you can buckle up and reduce it.