STOCK OPTIONS

What are they? Why should you care about them?

For the next few episodes, we are going to be focusing on exactly what stock options are, including put and call options, why they are important to you (yes, you!) and your trading, and how you can start to implement using them.

*Disclaimer: all forms of trading, including option trading, involves real risk. This is not advise, but education on what is possible.

Want to participate in the comments? Click here to watch on YouTube.

And if you aren’t subscribed to my channel for weekly videos – click here.

Listen to the audio version here:

You can also listen on iTunes and Stitcher

Having a lack of knowledge can destroy you

When it comes to trading in the stock market… most people only have one strategy: to hope that the stock goes up.

But we all know the market does NOT work like that 100% time. It is not an endless vehicle that ONLY goes up. Otherwise, EVERYONE would be in it and no one would lose money, right?

Here on earth, in reality, the market moves 3 ways: up, down and sideways.

With the next few episodes, let’s dive into strategies that could potentially allow you to protect yourself in a volatile market condition, and potentially even profit when the market goes down.

My goal for you:

The ultimate goal is for you to start using these in your trading. But at minimum, my goal for you is to be able to understand how option strategies work.

The reason options are so important to me is because it was the #1 way that I grew my account

Back in the day, when I just was getting started with trading, I was able to turn $10,000 into over $100,000 in just one year. And I could do that because of options.

If you have limited money, options offer you leverage.

You can get 2x, 3x, 4x the return on your money – IF you know what you are doing and know when the best use of options are.

Options allow you to control some of the most expensive stocks.

There are two concepts to investing in the stock market:

#1 – Ownership

This allows you to buy the stock and actually own part of the stock. You would have a certificate and collect dividends.

#2 Control

You would not actually own the stock. You would control the stock and get some of the profit for an amount of time, and then let someone else own it.

Most people do not care about the act of owning the stock itself, they just care about making money off of that stock.

Growing your account is just one half of the equation. The other is protecting your account.

Once you trade and get money in your account – how do you save it and not lose it? How do you protect it?

Options is the #1 way that I protect my account.

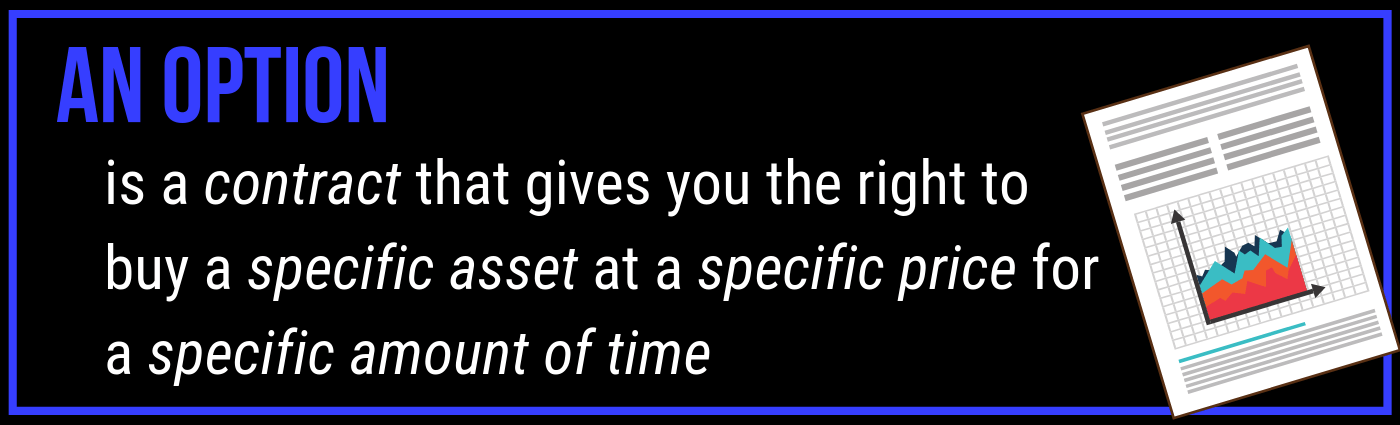

What is an option contract?

You may hear of someone who gets a certain salary a year AND they get “stock options”. Many people may not know what that term means… but that is where the real money is at.

A contract – a piece of paper or an electronic piece of paper that says you have the right to buy a specific asset

A specific asset – it could be a house or a car, but in this scenario we are talking about a stock

A specific price – you can buy it at a certain dollar amount

A specific amount of time – you don’t have the asset (the stock) forever to get it at that price. You may have a week, a month, a year.

Those are all of the components that are needed for the option.

BUT there is one last thing –

You need the cost of how much it will be to ENTER into this contract. The cost of how much it will be to hold that piece of paper.

And remember that there are always two parties with an option contract –

There is always a buyer and there is always a seller.

Some people ask… well, what if there isn’t a buyer or there isn’t a seller? There is ALWAYS a buyer and always a seller. Otherwise, you wouldn’t have a market.

Let’s break down this concept with an example…

…of a house

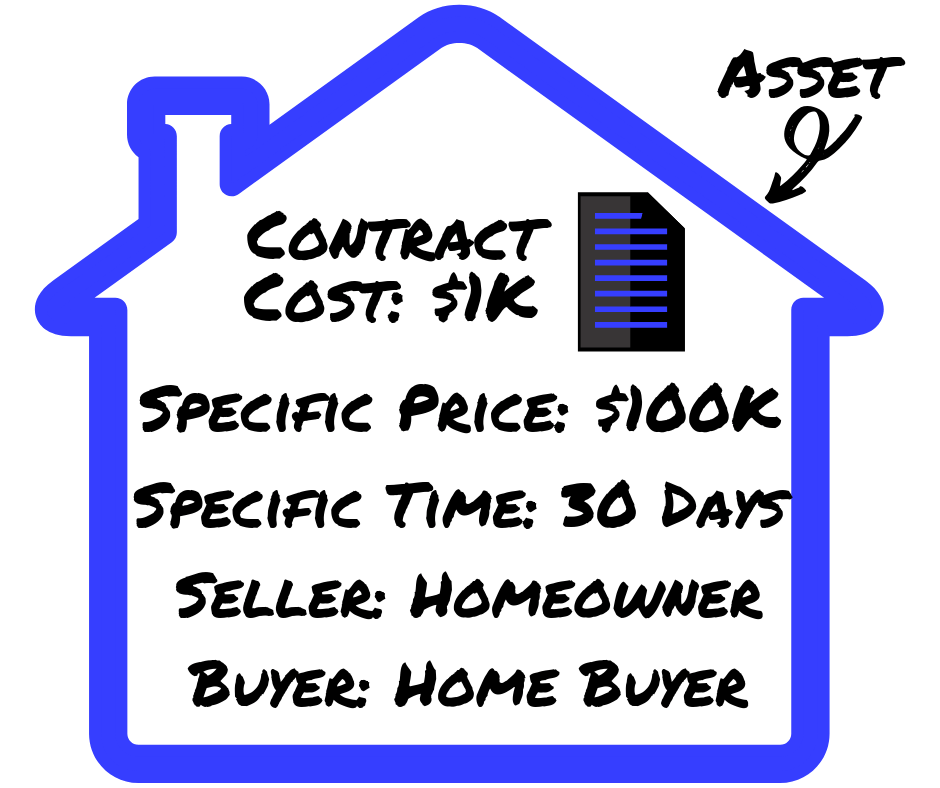

Let’s say someone already owns a house. And the homeowner is willing to sell it for $100,000.

The homeowner would be the seller and the house is the asset and they want to sell it for a specific price.

What we don’t have is a specific amount of time and a buyer YET.

Now Mr. Buyer comes in and he’s going to meet Mr. and Mrs. Seller. Mr. Buyer likes the house, can see his kids growing up there… and he says:

“I’d like to buy your house for $100,000…

BUT I want 30 days to make my final decision.

That will give me enough time to have an inspection and make sure everything is in tact.

Mr. Seller agrees to the 30 days BUT he requires a $1,000 deposit from Mr. Buyer to prove that he is seriously interested in the house.

And if Mr. Buyer does buy the house, they will put that $1,000 towards the cost of the house. But if he doesn’t, Mr. Seller will keep $250 of the deposit per week until he decides.

Mr. Buyer agrees and a contract is written up.

Now we have all of the elements of an option contract:

A contract – a piece of paper or an electronic piece of paper that says Mr. Buyer has the right to buy the house

A contract – a piece of paper or an electronic piece of paper that says Mr. Buyer has the right to buy the house

A specific asset – the house

A specific price – $100,000

A specific amount of time – 30 days

The seller – the homeowner

The buyer – the person buying the house

The cost of the contract – $1,000 for the down payment

Remember: Mr. Seller will keep $250/week of the $1,000 deposit until Mr. Buyer makes a decision.

What’s the benefit for the seller?

Mr. Seller is taking on risk.

For one, Mr. Seller can’t sell the house to anyone else, even if they have a higher price, within those 30 days because of the contract.

Another risk is that this house is still Mr. Seller’s asset. So if anything happens to it within those 30 days, he is still responsible for it.

Mr. Seller is only willing to take that risk if he is getting that $250 a week or until he gets the whole $1,000, OR Mr. Buyer does end up buying the whole house.

What’s the benefit for the buyer?

For the home –

#1 The first type of Buyer is someone who actually wants to live in the house.

They get an inspection done and if everything is okay, they buy it and live in it. And if it is actually worth more, than great! They get more than they paid for.

#2 The second type of Buyer is someone who is a whole seller or house flipper.

He likes the house and gives the deposit so he has the right to buy it. He does some research and believe this house will increase in value in the next 30 days. He believes it will actually be worth $110K in 30 days instead of just $100K.

So he takes control of the asset but doesn’t actually want to own it. He never plans on coming up with the $100K. he gives the $1K for the contract, then shops the house around to other realtors and says:

“I have a house under contract for $100K, and it will guarantee see for $110K. If you find a client who wants it, I will sell it to them for $105K.”

The flipper is thinking: I control this house for 30 days.

He has 30 days to find someone who sees the value in this house because it will probably be worth more by then. He is willing to sell it for $105K, $5K less than it could be worth.

If he finds someone else who wants to purchase the home, the “Buyer” can now say to New Buyer, “I am under contract for this house with this piece of paper. If you give me $5K, I will transfer it in your name and you can purchase it at $100K”

The Seller: Gets $100K

The “Buyer”: Gets $5K

The New Buyer: Buys the house and gets to live in it

So the “Buyer”/Flipper found a way to control a $100K asset without actually coming up with $100K and made $4K.

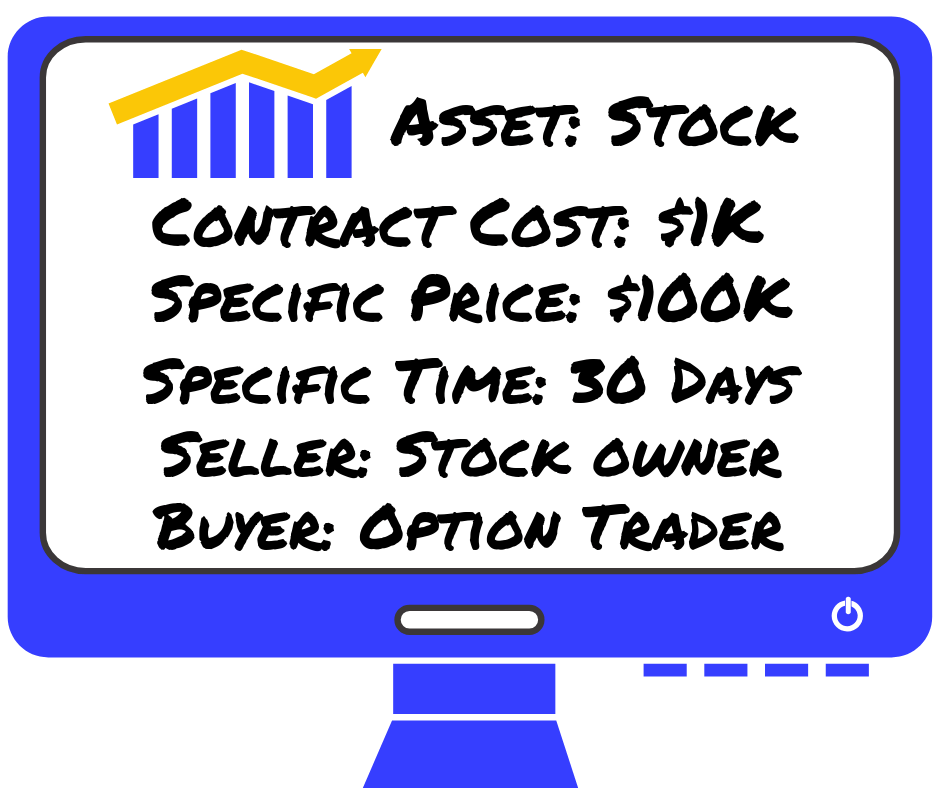

In the Stock Market –

#1 The first type of Buyer is someone who actually wants to buy the stock.

They get an agreement to make the decision in 30 days to buy it at a certain price. They are hoping that in 30 days that it is at least worth what they agreed to with that contract. If the price has increased – than, great! You are already locked in for that specific price.

#2 The second type of Buyer is an Option Trader – someone who just wants to control the stock and then flip it.

If he finds a stock at a certain price, he can control it for a certain amount of time by buying an option contract for a cost.

He can then control the stock for the agreed amount of time.

During that time, he can now find someone who is like Buyer #1 – someone who actually wants to own the stock.

He can then sell his option contract to the New Buyer for a cost, which allows New Buyer to purchase the stock at the set price in the contract.

For example – let’s use the same numbers as the house.

An option trader can come into contract for $1K to purchase a stock at $100K, but he has 30 days to purchase it.

An option trader can come into contract for $1K to purchase a stock at $100K, but he has 30 days to purchase it.

He believes that stock will be worth $110K based on the news, trends, and chart patterns.

He then sells the contract to someone for $5K, and that new trader can buy the stock at $100K because of the option contract.

So the Option Trader found a way to control a $100K asset without actually coming up with $100K and made $4K.

Ladies and gentlemen, this is option trading!

The goal as an option trader is to control stocks that you believe will increase by coming under an option contract and then selling that contract.

THIS IS HOW I was able to leverage and grow my trading account!

Because I did NOT have $100K to invest in the big boys that mattered in the industry – such as Amazon, Tesla, Apple.

I was able to CONTROL these same stocks and take advantage of the price appreciation.

The person on the other end buying the contract from you could be a bank, hedgefund manager – it doesn’t matter.

What matters is that there is a SELLER and there is a BUYER.

THIS is how you have the potential to get started with as little as $500, $1,000, $2,000! Because you are flipping stocks the same way that people flip houses.

You turn a small amount into a little bit more.

This is a simplified version to break down exactly what option trading is. Of course there are more details – like knowing how to read stock charts, when to buy, when to sell… but I wanted you to get the concept to see how it works.

Ask yourself, “If this makes sense – is there opportunity for ME to trade options?”