In part one of this series, we broke down exactly what a stock option is. Now we are diving in deeper…

INTO CALL OPTIONS

There are two types of options that make up 100% of the option trading with respect to the stock market: call options and put options

Want to participate in the comments? Click here to watch on YouTube.

And if you aren’t subscribed to my channel for weekly videos – click here.

*We are now on SPOTIFY*

You can also listen on iTunes and Stitcher

What is a call option?

An option is a contract that gives you the right to purchase an asset at a specific price for a specific amount of time.

Call and put options are extensions of that –

A call option is a bullish strategy that allows you to control a stock for a specific price for a specific time.

Bullish – when you expect the stock to go higher

Bearish – when you expect the stock to go lower

Call options allow you to invest in higher priced stocks for a fraction of the cost. And this truly was the key to my success early on in my trading life and exponentially growing my account.

When I first started trading, I only had $500 to spare and I put it into Sprint PCS stock, because that is who I worked for at the time. At $5/share, I was able to buy 100 shares.

I started to look at the big-boy companies and wondered…. how do I get into the Googles, Amazons, the Facebooks of the stock trading world? These were more expensive than 5 bucks let me tell you…

You may be entering into the stock market with a smaller amount of money…

And you may be drawn to penny stocks because you think that is all you can afford.

The problem with that is: Penny stock companies are typically getting ready to go out of business.

OR

You may not even dip your toes into the waters because you believe it is not enough to even get started with to do anything meaningful. So you wait until “I have more money to ‘lose'”.

The problem with that is: You need to start now to figure out how to put whatever money you have to work in the best way possible, to minimize risk.

THAT IS WHAT A CALL OPTION ALLOWS YOU TO DO

It allows you to get into the game and control some of the higher priced stocks that may have been “off limits” to you before and offers you leverage for a small account to see meaningful returns.

After started trading, I realized the power option trading had.

Because if you get GOOD – you can start paying things off. I had some student loans and was thinking about how long it would take me to pay them off just with my day job… verses getting involved in the stock market and being able to pay them off within 6-12 months.

You can use options to speed up time and get ahead.

How Does it Work to Buy a Call Option?

A very important component to being able to option trade is to be able to read stock charts. Then you are able to look at predictable, repeatable patterns on the chart and see, based on that analysis, where the stock is going to move.

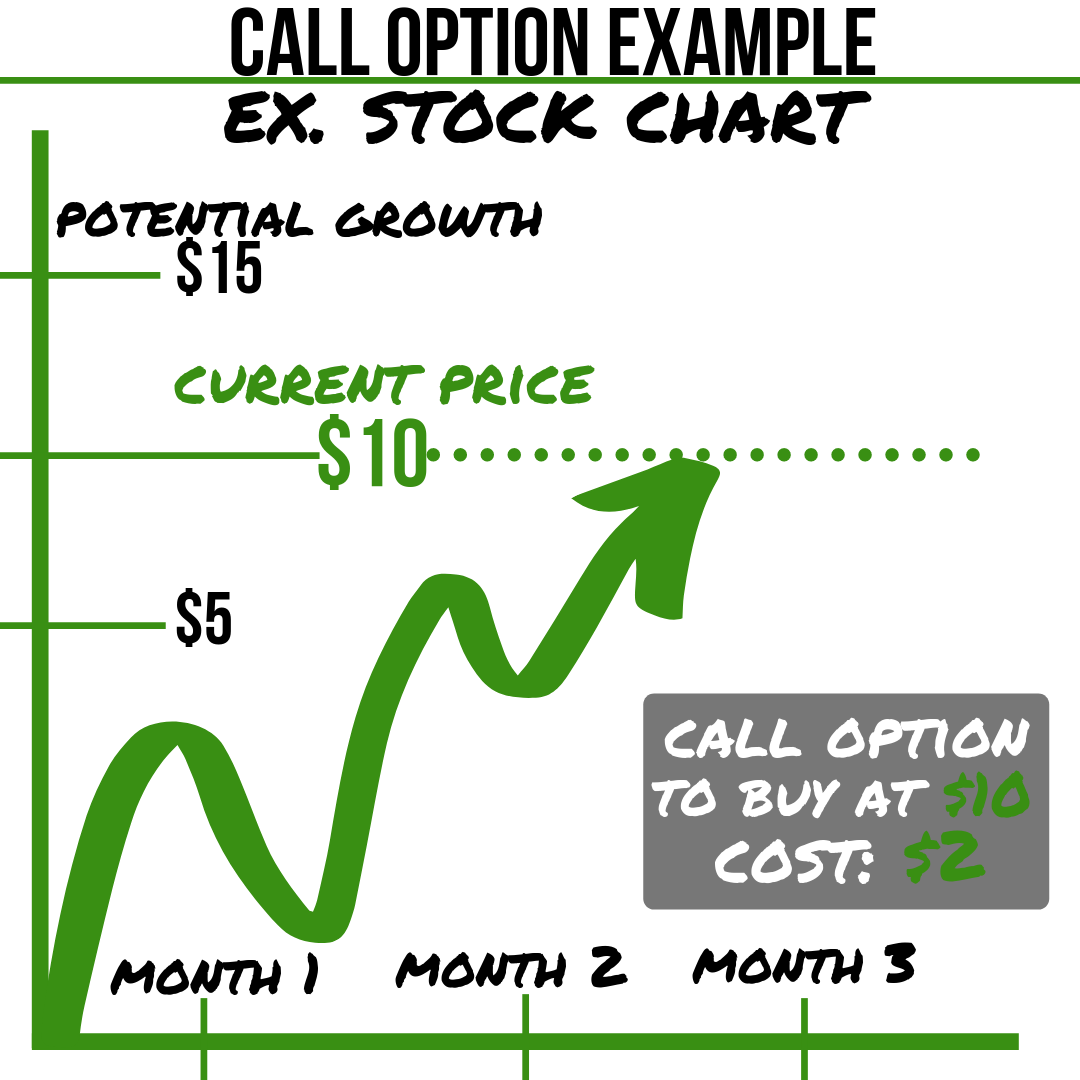

For example –

You may find a stock chart which indicates that it tends to move $5 with a certain pattern.

Based on that analysis, if you believe a stock that is currently trading at $10 will increase to $15, you could potentially buy a call option and control the stock rather than paying $10 to buy it.

You would buy a contract that says you can buy the stock at $10 between a certain amount of time.

You would buy a contract that says you can buy the stock at $10 between a certain amount of time.

The asset: the stock

Specific price: $10

Specific amount of time: depending on when you think the pattern would repeat itself and move $5, but for example 30 days

To obtain this call option contract, it will cost you a fraction of the cost rather than purchasing the stock.

Let’s say to purchase the call option contract for this stock it is $2.

You would pay $2 for the right to buy the stock at $10, which you believe will move up to $15.

If you are right and it does move, you have two choices:

Choice #1 – You can buy the stock at $10. With the call option cost at $2, your cost total was $12 instead of the current price of $15. So you are STILL saving $3 from the current market price…. and then you can immediately turn around and sell it for $15 because that is what the market price is.

Choice #2 – You could sell the call option contract to someone who else who wants to own the stock. You could sell the contract for $5, and that allows the Buyer #2 to purchase the stock at $10. (There are a lot of reasons why the Buyer #2 would want to do this, for example he may be an option trader and wants the contract before purchasing or wants to flip it too)

The contract is worth the difference of the increase in price (from $10 to $15 the stock went up $5, so the contract is worth $5)

If you purchased the contract at $2 and now sold it for $5 – you just made $3.

Whether you went with Choice #1 or with Choice #2, you made $3. With Choice #1, you made a 25% rate of return.

BUT with Choice #2, you made 150% rate of return AND you never had to put up $10 to purchase it.

THAT is what made me name what we do: POWER TRADES

Power Trades University, the platform for all my premium courses and coaching, is all about this: POWER TRADES.

Look at it this way:

If you had $10,000 and did the same example trade we did above –

You could make 25% return which is $2,500

OR

With selling the contract in Choice #2, you could potentially make 150% return, which is $15,000

*Disclaimer: There is always more to it and more details. This is beginner level education to give you an overview of the potential, not a guarantee. You would need more education in order to start trading options, for example with Power Trades University.

A Real Trade Example with Call Options

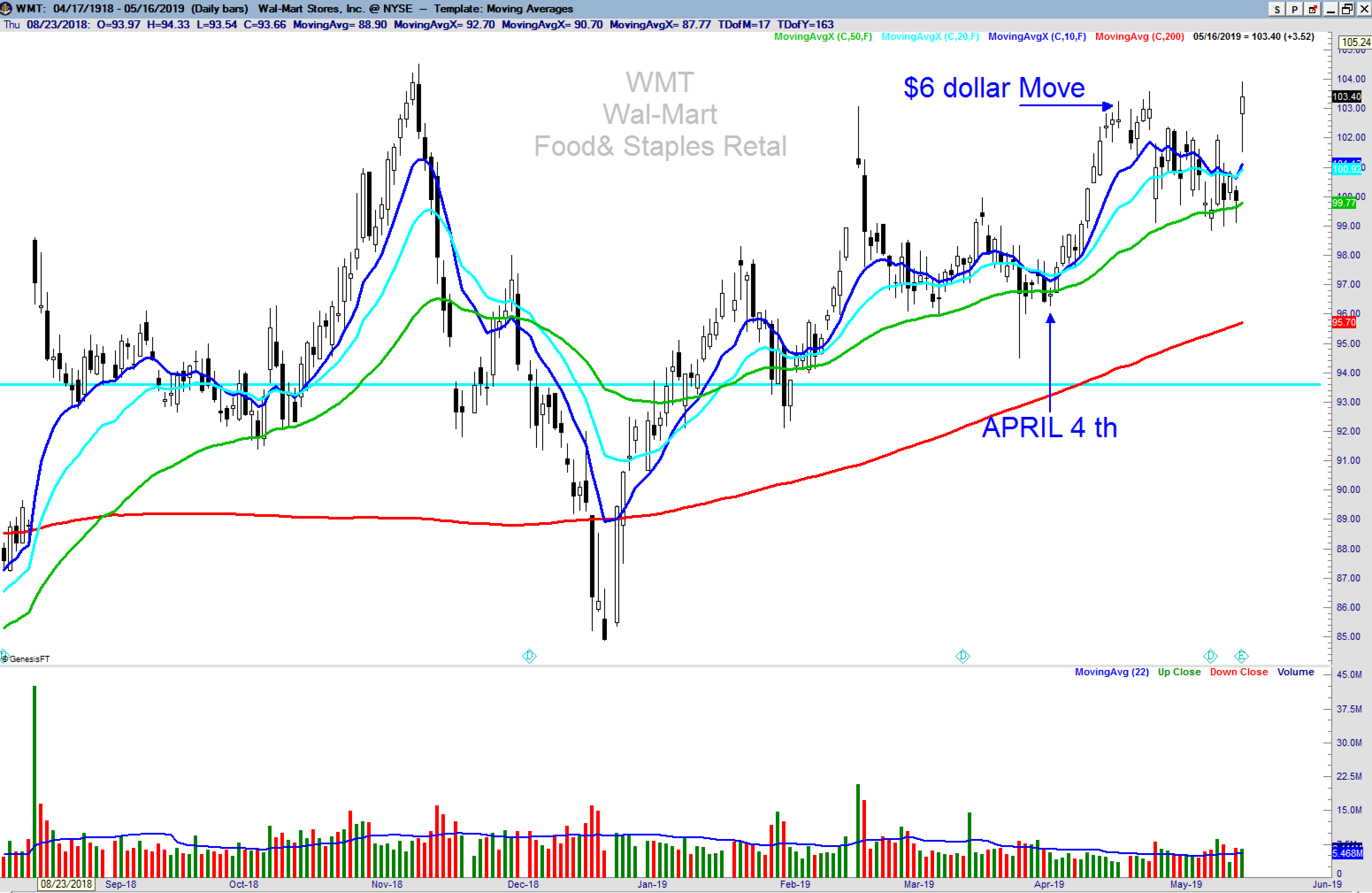

This is a real example with the stock Walmart.

On April 4th, 2019, Walmart was trading at about $97. From April 4th – April 18th, just 14 days, it went up to $103.

That is a $6 move in 14 days.

If you bought 100 shares of Walmart, it would have cost you $9,700. It moved $6 so at 100 shares that is $600 you can now put in your pocket. That is a 6% return.

Most people are not excited to put $9,700 on the line just to make $600. It’s not bad money… but let’s look at a potential option.

I am going to look at an in the money call option, which means that this option would behave like the stock. If the stock moves $6, the option may move $5. There is math equations to figure that out… but for now: the simple fact is in the money moves similar to market.

I like to teach my students to allow enough time for the market to do what you think it will do based on your analysis – as a rule of thumb, double the time.

It took 14 days for the stock to move $6 the first time, so I will look at options with expiration dates of about 30 days.

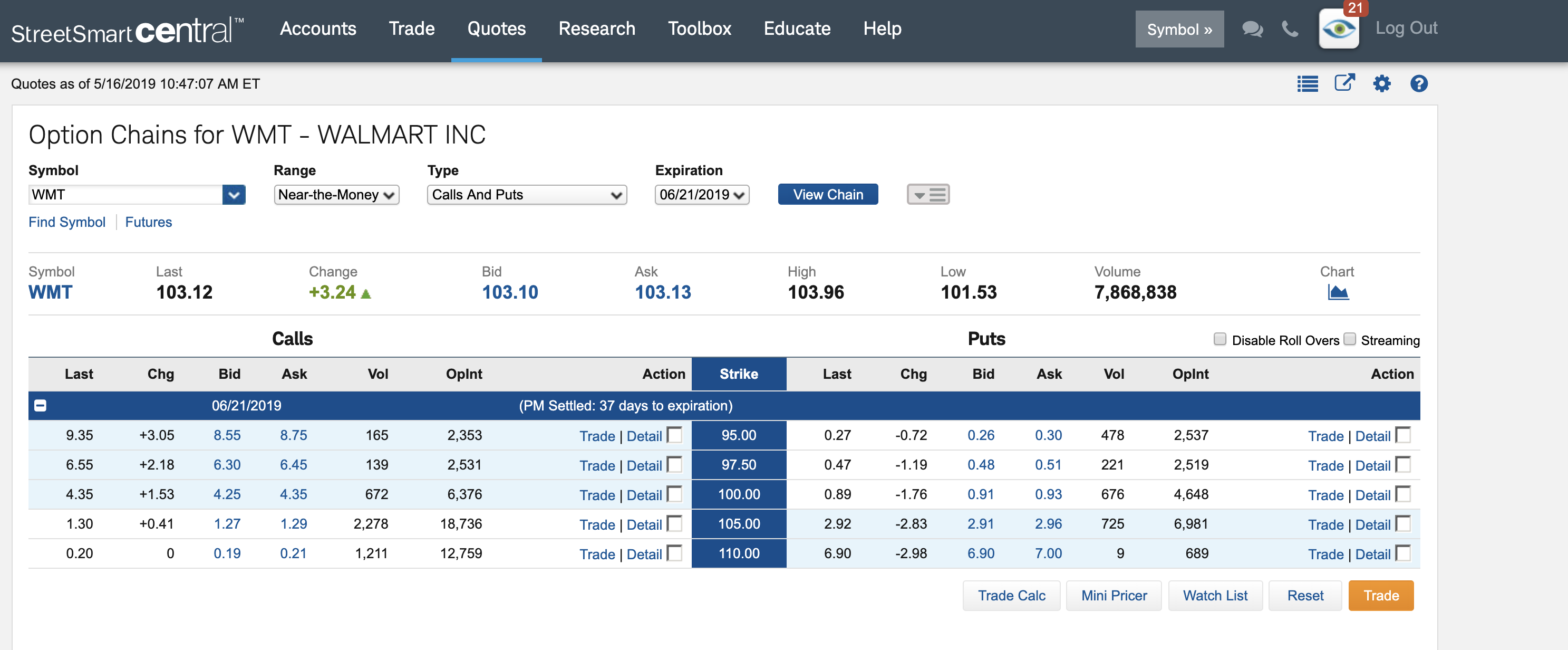

The option I am looking at expires June 21st, 2019 (at the time of recording it is the middle of May, 2019). The call option contract cost is $9.

One option contract controls 100 shares.

If you bought one option contract at $9, you would purchase it for $900.

If the stock did what we thought it would do, which is move $5, you would make about $500. That is a 55% return!

Instead of putting up about $10K, you only had to put up $900 for a call option. The stock moved $6 for both people – but the call option made a 55% return!

THAT IS HUGE.

Those are all of the pros of call options…. but there are some risks.

The “Negatives” About Call Options

Let’s continue to use the Walmart example.

If you purchase the contract for $900 and it does NOT do what it is supposed to do, here is what can happen.

Worst Case Scenario: If Walmart falls, you could lose either the whole $900, a portion of the $900, or break even depending on how much it falls. BUT you can always close the trade out early so you do not necessarily have to lose all of it.

And keep in mind… even if you bought the stock and the stock fell, YOU WOULD STILL LOSE. If the stock fell $2, you would lose $2 whether you bought the stock or bought the call option. The difference is – $2 is a lot LESS when it’s an option, it’s only $200 of that $900 you would lose. But when you OWN the stock, you do not have an expiration date. The call option does.

Here’s the thing:

Trading involves risk. You will not be right 100% of the time.

THE KEY is to be able to read the stock chart and determine, based on the pattern and previous history, where it is going to go.

If you haven’t seen some of my case studies about our profit power with option trading, click here to check them out.

With call options, it’s not about taking a lot of trades. It’s about taking the RIGHT trades. The Power Trades for the Power Profit.

Call options allow you to control higher priced stocks for a fraction of the cost.

Be sure to check out our next episode where I break down how PUT OPTIONS work.