Looking At An Empire

If you haven't been following the Tesla stock chart, it's current at a multi-year low. Many Tesla stock owners have sold their shares to prevent losing money, but now that the stock has crashed and burned, where do we go from here?

As a frequent Tesla stock owner myself, as I watched the charts I predicted a few weeks back that Tesla would break the $120 stock price, and it did... and fell further.

So is it a good time to buy right now? Should we wait?

To answer those questions, we want to take account of what's going on with Tesla as a company in the news and also deep dive into the chart to predict where the stock might possibly go.

Tesla In The News

A good way to check on a company and predict what may happen to the stock price is to consider what's being said about them in the news.

In one article, Wedbush (a private investment firm) is losing faith in Tesla, due to a demand slow down and the increasing interest rates.

While this isn't something Tesla can control, most people cannot just pay cash outright for a Tesla automobile and have to take a loan with a higher interest rate to buy. With supply chain issues, some of their vehicles have seen a price increase to keep up with the higher prices to manufacture.

Another issue Wedbush brings up is the leadership void happening at Tesla. When Elon Musk bought Twitter, he focused his resources there instead of Tesla.

Tesla is also reducing production at one of their main production plants in Shanghai through January which could signal a lower demand for product. If the demand is not lower, this could also spell trouble as they may not be able to meet the current demand if production is lowered.

Tesla may also be experiencing a decline in demand in their Chinese market (which accounts for about 25% of their total sales) as competitor NIO is also seeing some decline in stock price.

Looking At The Tesla Charts

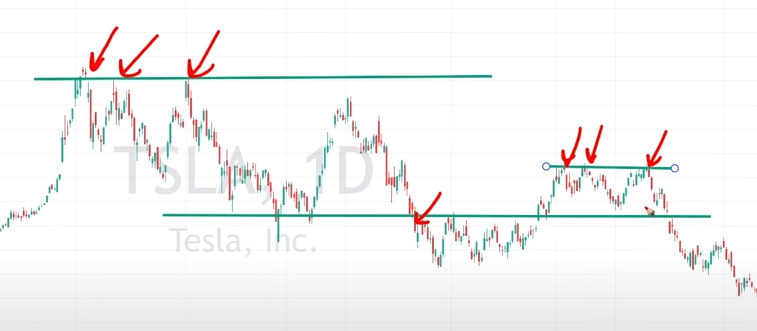

When we look at Tesla's chart, or any stock chart, we want to find some certain levels to make our predictions more accurate.

We want to find the highest price that the stock is averaging - the resistance value. We know at this point, it's a great time to sell to make the most profit.

At the stock's lowest level, known as support, this is the average lowest price the stock is hitting. At this price point, we want to buy.

Now both of these are averages - which means the stock CAN go higher or lower than these values. But by finding these points first, we can better predict if it's a good time to buy or sell.

As an example, when Tesla did the 3:1 stock split, the resistance value was around $400 USD, and support was around $250 USD.

In November of 2022, Tesla broke the support value and that transitioned to the new resistance level due to the stock falling.

As of this post date, Tesla is currently trading at less than $120 per share.

Knowing the support and resistance values is SO important. Imagine if you were to buy Tesla at the $250 price and be able to sell it at the $400 price.

Can We Expect Tesla To Go Higher?

As of right now, all we can do is wait and see what happens. There are a few factors that may be influencing Tesla stock price, such as:

1. Elon Musk needs to find a CEO for Twitter to take some of the responsibilities off his hands.

2. Once the issues from the Shanghai plant are resolved and production can resume at it's normal capacity, Tesla should be able to make demand.

3. End of the year tax season is coming. Some buyers may sell their shares and claim the tax loss or offset gains from other sales.

We can also consider how Elon Musk's selling of shares to fund Twitter may affect the stock as well.